Summary: If you want to save for college, there’s probably no better choice for Coloradans than the College Invest 529 plan.

Read this for updated Info as of 10/6/23

We live in an interesting time. There’s no question that, right now, having a college degree is really helpful both in getting and staying employed and in earning more while employed. But that doesn’t mean that college is the right choice for everyone, and some folks are beginning to wonder if the traditional college degree will retain it’s place of prominence for much longer.

Of course the purpose of an education is more than just preparation for employment, but certainly that’s a big part of why many folks choose to go to college, so this poses a dilemma. We don’t know if college will continue to be the “path” to career success, yet it is so expensive that most folks with children will need to save up some money ahead of time to help pay for it. My crystal ball is way too cloudy to definitively answer this but, should you choose to at least hedge your bets and try to save up some money in advance, I can give you some good advice on how best to do that.

The short answer is, especially in Colorado: a 529 plan. Like 401k and Section 125 plans, it’s named after a section in the tax code. It allows you to invest money for your child(ren) and the investment grows tax free, and then any qualified withdrawals (used for higher education expenses) are also tax free. It’s similar to a Roth IRA in the sense that you put after-tax dollars into it and then earnings and withdrawals are tax free, except the purpose for the money is different and the timeline is shorter.

While you can choose any 529 plan, in many states (including Colorado) it makes sense to choose your state’s plan because they offer additional incentives. In Colorado’s case, your contributions are tax deductible which, in effect, means you earn an automatic 4.63% return on your money when you deposit it. (You don’t actually get that money until you file taxes for that year, at that point it reduces the taxes you owe Colorado so that you either pay less or get a larger refund.)

They are way too many nuances to 529 plans to cover in one blog post (this site has lots of information), but here are the basics of what Coloradans needs to know:

- College Invest is the Colorado state plan

- Choose the Direct Portfolio

- Decide what your total goal is by the time your child(ren) graduate from high school and contribute accordingly

- Get started now

There’s much more to it, of course, including choosing how to invest the money, but those are the basics. We started ours for our daughter as soon as she had a social security number, because that’s required to open a 529 plan. (Because she was adopted at 9 months, and then had to go through the citizenship process, this was a little later for us than for many of you.) But you can even begin to save before they are born, either by putting away money that you will eventually transfer into a 529 plan after they are born, or by opening up a 529 plan and then changing the beneficiary once your child is born.

Once the account is opened, you can invest lump sums whenever you want, or set up automatic investments from a checking or savings account that occur every month. We did both, plus for a while we had a rewards credit card where the rewards went directly into the 529 account. You then choose your investment options, choosing between an age-based option (similar to target-date funds) that automatically shift to more conservative investments as your child approaches age 18, or by choosing a particular portfolio. The portfolios changed a bit in 2004, but since that change we’ve been in the “Growth Portfolio“, which is 75% stock/25% bond.

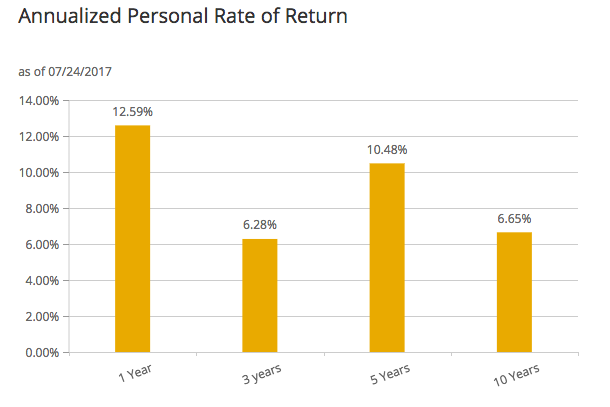

That might be too aggressive for some folks (especially as our daughter is about to begin her senior year in high school which means we’re close to the withdrawing phase), but because of our overall financial security, and because of the bond-like nature of our PERA pension, it was a good fit for us. For reference, here are the actual returns our account has earned (your account will always be somewhat different than the generic portfolio return because of the timing of your contributions).

Note that the 10-year return currently includes 2008, which is pretty remarkable that it’s still so high. Going back to October of 2004 (when the portfolio changes occurred), our total annualized return has been 6.7%. At this point we are debating whether to shift the portfolio to a bit more conservative choice but, because the conservative portion of these portfolios are in bonds and that segment of the market has its own issues right now, we’re not sure. Given we still have 5 years left (senior year plus at least four years of college), equities are still likely to outperform bonds over that period.

Either way, this account has been incredibly successful for us (more on that below). Which brings up a big concern that some folks have – what if you don’t need the money? The reasons to not need the money can vary from your child ends up not going to college, to your child earns scholarships, to you actually saving and earning more than you need. Thankfully, there are options for dealing with each one of these.

-

- Your child doesn’t go to college: First, there are a variety of post-secondary options other than college that sill qualify. If none of those apply, you can always change the beneficiary to another child or even to yourself or eventually a grandchild, or you can withdraw the money for non-qualified expenses. If you do the latter you pay federal and state taxes plus a 10% penalty on any of the earnings that you withdraw (not on the contribution portion). For any of the contribution portion you withdraw that you took a Colorado tax deduction at the time of contribution, you would have to make Colorado “whole” on those taxes. While this may sound bad, it’s really not. In the end it’s “extra” money that you wouldn’t have had otherwise (because it would have gone to the college).

- Your child earns scholarships: For whatever dollar amount in scholarships they get, you can withdraw that amount of money for other purposes. Similar to #1 above, you would have to pay federal and state taxes on any of that that was from the earnings portion (not contributions, as you already paid tax on those), but you would not have to pay the 10% penalty. You can of course still pay for expenses not covered by the scholarship, and you can leave the money in for future use (or for a future beneficiary).

- You end up with more money than you need: Your options are the same as #1 above.

- Your child doesn’t go to college: First, there are a variety of post-secondary options other than college that sill qualify. If none of those apply, you can always change the beneficiary to another child or even to yourself or eventually a grandchild, or you can withdraw the money for non-qualified expenses. If you do the latter you pay federal and state taxes plus a 10% penalty on any of the earnings that you withdraw (not on the contribution portion). For any of the contribution portion you withdraw that you took a Colorado tax deduction at the time of contribution, you would have to make Colorado “whole” on those taxes. While this may sound bad, it’s really not. In the end it’s “extra” money that you wouldn’t have had otherwise (because it would have gone to the college).

For us, we may actually end up being in the position of having more than we need. Because we did a good job of contributing (especially a fair amount in the early years so it could compound), and because the returns have also been pretty good (recently the earnings portion of our portfolio exceeded how much we’ve contributed), it’s likely Abby’s total expenses will be less than what we currently have in the 529 plan (barring a severe market downturn in the next couple of years, or she decides to go to med school). (Make no mistake, this is a good position to be in.)

We can’t really tell yet, because we don’t know for sure which college Abby is going to, how much it will cost, what if any scholarships she might receive, how many years it might take her to finish, or whether she chooses to pursue anything beyond a bachelor’s degree. Plus there are other factors, including the American Opportunity Tax Credit, which means that at a minimum we’re going to want to spend $2000 a year from outside of the 529 plan (and perhaps as much as $4000) in order to claim that credit. But at this point my best prediction is that when she finishes her college work, we’ll have to decide whether to withdraw what’s left or leave it for possible future use by us or Abby’s possible children. Again, a good problem to have, and definitely not a potential reason to shy away from using a 529 plan.

If you live in Colorado and want to save some money for your child(ren)’s higher education, you should definitely be looking at a 529 plan as part of your larger financial plan. If you choose to work with me, this would certainly be part of our discussions. And keep in mind that while it’s better to start right after they are born to maximize the compound investment earnings potential, it’s never too late. Even if your child is in college now it makes sense to funnel your payments through the 529 plan. Even though they might not be in there long enough to really benefit from the tax-free investment growth, you will still get the 4.63% Colorado state tax rebate. When most folks are paying $20,000 and up (sometimes way up) a year, 4.63% isn’t nothing ($926 if it was $20,000).

Great advice for parents and so well written. We are so glad we prepared for Zacks college. He has 2 years to go & we are hoping no college debt!

LikeLike

That’s great (for you and especially for Zack).

LikeLike