Colorado PERA is required by the state legislature to submit various reports on a variety of topics. One of these is the annual Signal Light Report (2024 Report PDF, based on 12/31/23 valuation), which is designed to give a “status update” on PERA’s progress toward full funding by the 2048 goal. It attempts to take a very complicated and complex topic and simplify it to a “signal light” indicator, with Green meaning things are good, Yellow meaning caution, and Red meaning stop what you are doing, things are really bad.

This year’s report is 54 pages, and while I realize most people won’t read the entire thing, it is a really good overview of the complexities of trying to project out PERA’s funded status over time, as well as a good status update on how the plan is doing. While I encourage you to read the entire report, I will attempt in this post to pull out the highlights as well as include some commentary of my own.

This is the fourth annual Signal Light Report, and it’s important to understand that the report itself has changed over those four years. Each year the actuaries take feedback from the PERA Board and other stakeholders and try to improve the report. A big improvement this year is including the impact of any expected adjustments (the Automatic Adjustment Provision (pdf), or AAP) that would kick in under various scenarios. Previously, the projections simply did simulations based on current funding and benefits, and did not take into account the impact of the AAP kicking in on those scenarios where it would kick in. This meant that in the out-years, the report became somewhat useless, because in both bad and good scenarios the projection didn’t reflect the changes that would automatically occur from the AAP (as well as eventual potential changes to the Amortization Equalization Disbursement (AED) and Supplemental Amortization Equalization Disbursement (SAED)) that are codified in already passed state legislation.

The projections still don’t incorporate any proactive action the legislature would take in very bad or very good scenarios, because there’s no way to predict that, but of course the legislature would act under those scenarios.

The actuaries use a “stochastic” modeling process instead of a static one that assumes a fixed return each year. So they model 5,000 different scenarios with different sequence of returns and use those results to assign a “color” to each of the five divisions within PERA: State, School, Local Government, Judicial, and DPS. Here are what the signal light colors mean.

While we often talk about the overall funded status of PERA, the actuaries track the individual funded status of each division separately.

The stated goal from various reforms (including SB 18-200) is to get all of PERA’s divisions to 100% funded status by 2048. But it’s important to realize that the goal was also not to get there too quickly, which is somewhat counterintuitive. The legislature wants to get to full funding, but doesn’t want to make draconian changes to contributions or benefits to get there, as that would have adverse effects on PERA members (including retirees), PERA employers, and Colorado taxpayers. This is why it’s a 30-year process, with cumulative effects having a much larger impact over time. Here is the current status of each division from the 2024 Signal Light Report (based on 12/31/23 valuation), along with the status from last year for context (the median of the 5,000 projections, or the 50th percentile, determines the color).

Overall, this is a good “signal”, as three of the divisions are on track for full funding by 2048, and the other two are “close.”

The small discrepancy between the Valuation Basis and the Signal Light Basis is that the Valuation Basis does not take into account possible AAP changes.

The small discrepancy between this table (both columns) and the signal light “color” is due to this table assuming all assumptions are exactly correct, whereas the color is based on stochastic projections.

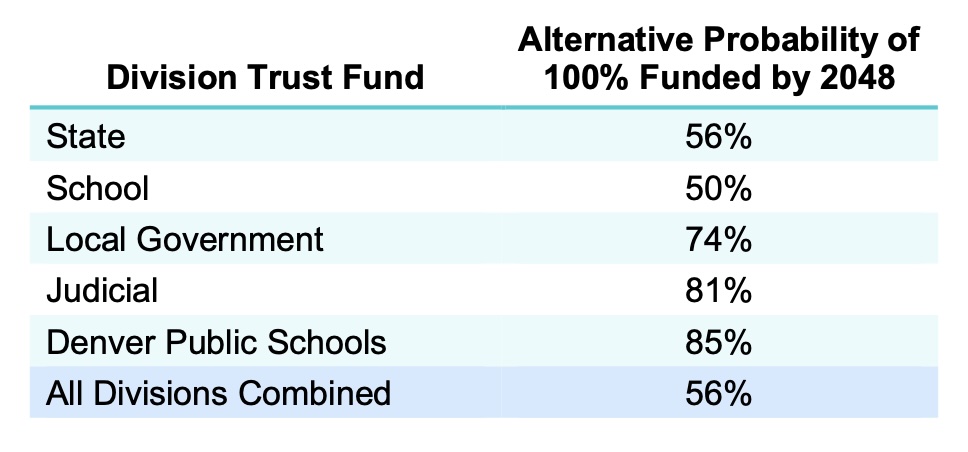

Interestingly, the above only counts “success” if it achieves full funding by 2048 and stays above 100% through 2048. If you include all scenarios where full funding is achieved by 2048 (even if it drops back down to say 99% funding before 2048), the results look like this.

But, as with any projections that look out this far, there is a lot of uncertainty (and lots of sequence of returns risk), so a couple of years ago the report also added some shorter-term views so people wouldn’t be “surprised” by changes that might be triggered (such as the AAP). So, for example, here is the one-year analysis, showing several factors (in isolation) that would be necessary to trigger the AAP (in either direction) by the end of 2024.

As you can see, it is very, very, very unlikely (but not impossible) that the AAP will be triggered by the 12/31/24 valuation. A perhaps more useful short-term analysis is the ten-year outlook.

This indicates that there is a decent chance of a “negative” AAP trigger in the next few years, but that probability steadily decreases over time (and the probability of a “positive” AAP trigger, while unlikely, starts to be more likely than a negative trigger).

The return on investments that PERA achieves is the most important variable and the returns over the next few years have an outsized effect on long-term projections. PERA has consistently achieved returns that exceed the assumed rate of return (currently 7.25%), but the market is going to do what the market is going to do, so there are no guarantees.

What Does It All Mean?

Well, the Signal Light Report is just that, a “signal”; it’s the actuaries best estimate of what will happen. It’s not like it’s based on the laws of physics and, as the full report indicates, there are many, many variables at play. But, overall, my takeaway is that PERA is on track. The reforms the legislature has made (higher contributions, less generous benefits) take time to have an impact on PERA’s funded status (insert obligatory “it takes time to change the direction of a cruise ship” reference); we need to have patience to let the process play out. That doesn’t mean we shouldn’t be vigilant and make changes if they become necessary, but it does mean we shouldn’t overreact to short-term events.

Hi Karl,

I just discovered your blog and wanted to thank you for helping me to make some sense of this data.

Dan

LikeLike

Glad you found it helpful.

LikeLike