Every four years Colorado PERA does an Experience Study. This is a process where their Actuarial Consultant takes a look at the assumptions inherent in the calculation of PERA’s funded status in light of current economic and demographic assumptions as well as the actual experience in PERA’s plan over the last four years. Based on this study, the PERA Board then adopts changes to those assumptions for the next four years. These assumptions include data like the assumed rate of inflation, the assumed rate of return on PERA’s investments, mortality, wage and payroll growth, and the ages at which PERA members choose to retire. These assumptions work in concert with PERA’s actual liability at any given time (typically the year-end valuations) to project its funded status into the future.

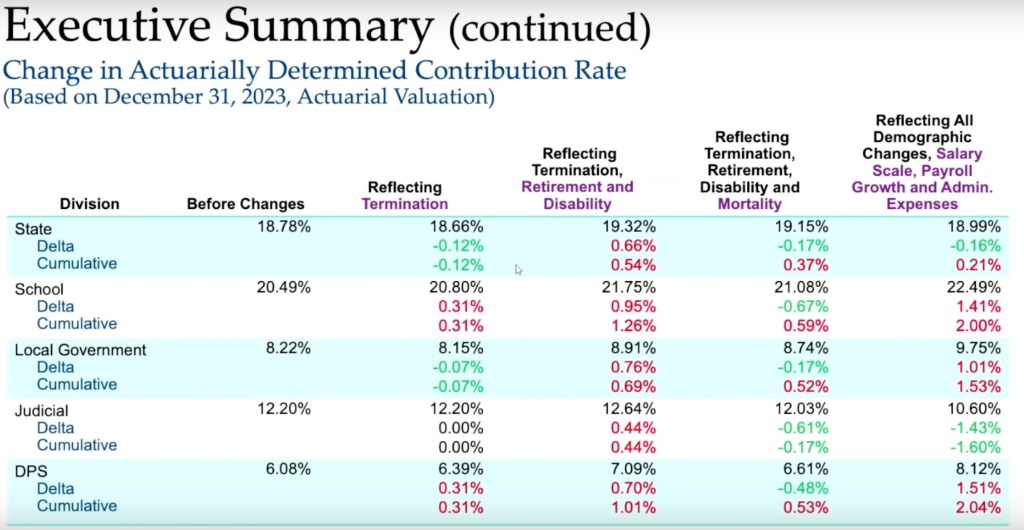

In today’s meeting the Experience Study was presented and the Board voted to adopt the suggested changes in assumptions. While the Experience Study showed some changes in most assumptions (some positive and some negative, as is normal), the changes that had the largest impact were around wage growth, retirements, and payroll growth.

- Wage Growth: Wages increased by a larger amount than expected over the last four years. This is even after taking into account the higher-than-expected inflation. (In other words, wage growth not only exceeded inflation, it exceeded inflation plus the assumed wage growth.)

- Retirements: I missed the detail on this, but essentially the expected liability from retirements was higher than predicted, which is likely a combination of higher than expected final salaries for retirees (likely partially due to that wage growth) and earlier than expected retirements. (I’ll update this if I get clarification on that.)

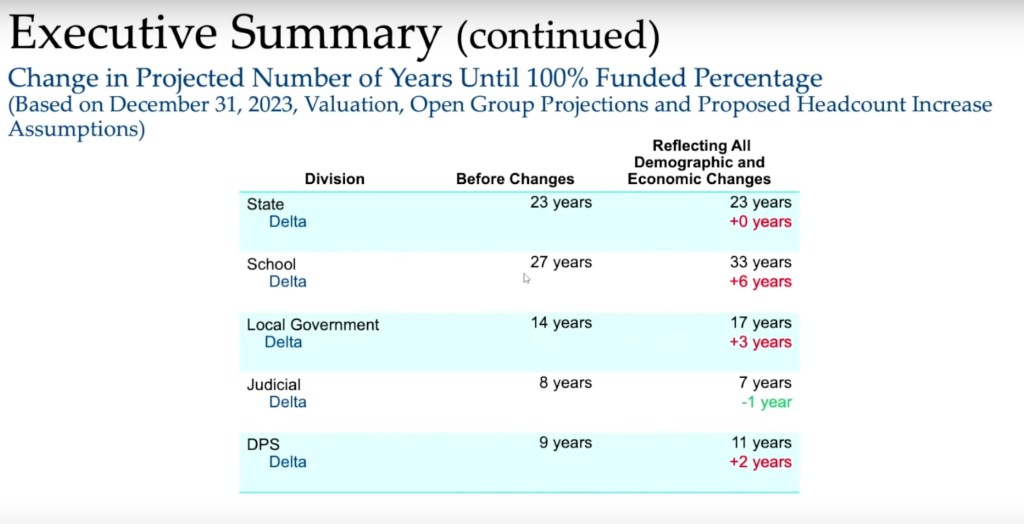

- Payroll Growth: This is a biggie. The increase in payroll, which in this case refers to head count (number of people employed by PERA-covered employers), was much lower than expected, especially in the School Division, DPS Division and the Local Government Division. Here’s a look at the change in payroll growth assumptions that the Board adopted.

All three of these changes result in increasing the projected number of years (in most divisions) until PERA is fully funded. (Note this is based on the December 31, 2023 valuation as the December 31, 2024 valuation won’t be completed until June, so these numbers will be a bit different when that comes out.)

None of this is particularly unexpected, but it does have some implications around the triggering of the Automatic Adjustment Provision (AAP) (pdf). To be perfectly clear, nothing is changing right now, and there is no guarantee that anything will change in the future. But based on the assumption changes from this Experience Study, there is a good chance that the December 31, 2025 valuation (the one done at the end of this calendar year) will trigger the AAP. (To trigger on the low end, PERA has to be below 98% of being “on track” to full funding by 2048. To trigger on the high end, it has to be above 120% of being on track.)

If (and, again, it is still definitely an if) the December 31, 2025 valuation (which is completed in June of 2026) does end up below 98%, then the AAP would be triggered and take effect on July 1, 2027 (the lag is to give employers time to adjust their budgets). What this would likely mean is that beginning July 1, 2027, both the employee and the employer contributions will increase by 0.5% (to 11.5% and 21.90%, respectively), and the Annual Increase (COLA) for retirees will decrease by 0.25% from 1.0% to 0.75%.

Again, just to be clear, this may not happen. But the chances are reasonably good, so I thought it was worth posting so that folks could start planning ahead.