Nobody really likes it when the markets are down, especially when they are down significantly in a short period of time and the expectations are that it might (although nobody knows) continue to decline a fair amount more. People who are invested in the market look at their accounts and see how much they’ve lost, and people who aren’t invested in the market worry about the impact on the economy. It’s stressful.

I am not discounting those feelings, I experience them myself. But if you are a long-term investor (and you should be), you have to be very careful not to overreact and make decisions based on fear. If you’ve set your asset allocation based on your goals, your risk tolerance, and your investing time-horizon, then there’s no need to panic. (If you haven’t done that, there still is no need to panic, but you really should take the time to dial in your preferred asset allocation.)

I think it can also be helpful to look at the (possible) upsides of a down market, because they do exist.

Stocks Are On Sale

“Stocks are on sale!” is the typical response of buy-and-hold investors (like myself), but I think it helps to expand on that a bit. If you are in the accumulation phase, meaning that you are still working and not withdrawing anything from your retirement accounts, then a down market (as long as it doesn’t stay down forever) is a good thing. Stocks really are on sale. So if you are making contributions from each paycheck to your 401k/403b/457b/IRA/HSA, those contributions are now buying many more shares than they were a couple of weeks ago (or even a couple of days ago). So when the market eventually recovers, the money you are investing now will earn a higher return than if the market hadn’t dived in the first place. And your existing holdings will be back to “even”, with “even” being at a level that has seen about 15 years of really great gains.

Tax Loss Harvesting

If you have investments in taxable brokerage accounts, then it’s possible that relatively recent purchases are under water, meaning their value is less than what you paid for them. If that’s the case, that gives you an opportunity to do tax loss harvesting. By selling those specific holdings, you can realize a loss on your investment that you can then deduct on your taxes when you file for 2025 (or carry forward to future years if your loss is great enough that you can’t use all of it on 2025’s return). After you sell, you can then turn right around and invest that money (at roughly the same market level) and then benefit from any gains. So those particular investments are worth the same, but you just saved (earned) some money on your taxes. (You do have to be aware of the wash rule and invest in something that isn’t exactly the same as what you sold, but you can find something that’s fairly similar that won’t violate the rule.)

The Benefits of Diversification and Rebalancing

When I say that “markets are down significantly”, what I’m really referring to is that (parts of) the U.S. stock market is down a lot. Here are year-to-date performances of several different portions of the market.

- NASDAQ: -19.15%

- Broad U.S. Stock Market (VTSAX): -14.11%

- U.S. 2040 Target Date Fund (VFORX): -6.23%

- Broad International Stock Market (VTIAX): – 2.02%

- Broad U.S. Bond Market (VBTLX): +2.53%

- Money Market Funds (VMFXX): +1.10% (current 7-day yield 4.31%)

So let’s say (just as an example) you’re allocated 80% stocks and 20% bonds, with 60% of your stocks in U.S. Stocks and 40% in International Stocks. Your year-to-date return is -6.9%. That’s not great, but it’s also not -14% or -19%.

And, if you’ve been periodically rebalancing, then in the past few (~15) years you’ve been occasionally selling U.S. stocks and buying International Stocks and U.S. Bonds. Which means you’ve been practicing “selling high and buying low”. If this market decline continues, and continues to disproportionally impact certain portions of the market, then your future rebalancing actions will continue to “sell (relatively) high and buy (relatively) low”. That’s a good thing.

RMDs and Roth Conversions

If you are retired, then the “stocks are on sale” argument doesn’t feel quite as good because you aren’t earning a significant income and regularly buying more in your retirement accounts, so you can’t take advantage of the sale in that way. But that doesn’t mean a down market doesn’t provide opportunities to you.

If you are old enough that you are having to take Required Minimum Distributions (RMDs) from your pre-tax retirement accounts (traditional IRA, 401k, 403b, 457b), or from inherited pre-tax IRAs, the RMD is calculated on your balances as of December 31st each year (in this case, December 31st, 2024). For those folks who do not need that money to live on because their spending needs are taken care of by other income (like a pension or Social Security), a down market can actually be a good thing. Because if you take your RMD when the market is down, you are withdrawing more shares from your pre-tax retirement account. While that may seem like a bad thing, what you are doing is lowering future RMD amounts; and if you are not needing to use the RMD for spending, you can turn right around and invest it in a taxable brokerage account (or, even better, a Roth account if you have some earned income). You are effectively lowering your future tax burden by selling more shares when the market is down. (To be clear, if you are having to use the RMD for spending, a down market is definitely bad.)

If you are not old enough that you are having to take RMDs, then a down market is an excellent time to consider a Roth conversion. A Roth conversion is when you decide to convert some of a traditional, pre-tax account (IRA, 401k, 403b, 457b) to a Roth account. This conversion is considered a withdrawal for tax purposes, so you will have to pay taxes on the amount when you file your 2025 taxes. It depends on a variety of factors (including, but not limited to, your current federal and state taxable income and tax brackets, your expected future taxable income and tax brackets, whether you are getting a subsidy through the ACA marketplace for health insurance, you are getting a tax deduction or credit for something that is phased out with higher incomes, etc.), but paying more taxes now is often advantageous. Similar to the RMD discussion above, because the market is down you are converting more shares from pre-tax to Roth but are getting taxed on the same dollar amount as if you had converted that dollar amount when the market was higher. Because when you do a Roth conversion there is no wash sale rule, you can immediately invest in the exact same investment in the Roth as you had in the traditional account. Which means any future gains (again, on that higher share amount you were able to convert) will now be completely tax free. In addition, your Roth is not subject to RMDs, so the conversion lowers your future RMDs from the traditional account which also gives you additional tax flexibility. (While this is generally a strategy people use before taking RMDs, note that you can still do Roth conversions even when you are old enough that you have to take RMDs. It’s just that the RMD itself can’t be a Roth conversion, it has to be a withdrawal, and any Roth conversions have to be above and beyond the RMD.)

Zooming Out and Perspective

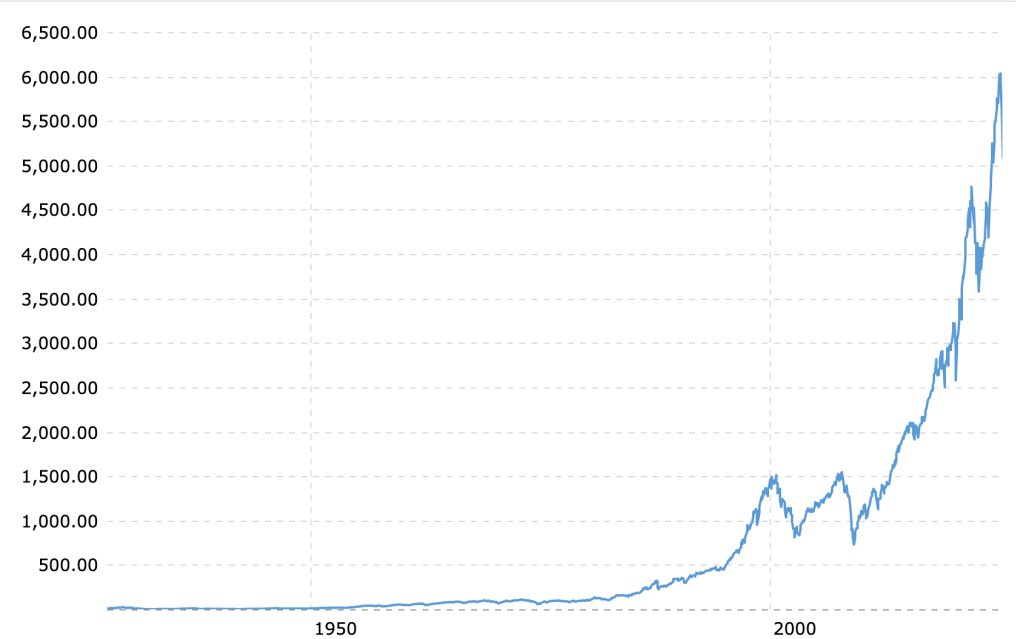

Again, it’s not fun when markets are down significantly. But as is often the case, it can be really helpful to zoom out a bit. In this case, zoom out to May 2, 2024, which was about 11 months ago. The S&P 500 is at roughly the same level today as it was on May 2, 2024. The pessimistic way of looking at that is we’ve had 11 months of no gains (and this is true). But for the long-term investor, the better way to look at that is in the context of roughly 15 years of stellar gains. On May 2, 2024 you were probably feeling really good about your investments. I mean, really good; the compounded annual return of the broad U.S. stock market for the previous 10 years was about 13% per year. So if you were feeling great about your investments on May 2, 2024, and your investments are worth exactly the same today as they were then, why are you feeling so bad and so stressed? Perspective.

I want to reiterate that none of this is meant to discount your current anxiety. I have it as well. And while I haven’t specifically mentioned politics in this post (until now), there is certainly the added factor that this particular market downturn appears to be somewhat self-inflicted as opposed to a “normal” correction. If you follow me on social media, then you know that my politics are very different than the current Administration’s, and that I am very upset by pretty much all of their actions (not just economic actions). So I am not suggesting that you can’t be upset or angry about this situation, or that you can’t take whatever political actions are available to you to express that dissatisfaction. You definitely can (and should) do that if you are so inclined. But assuming that these current political actions do not last and result in a complete reordering of our global financial systems (which, I admit, is an assumption), then historically markets will recover and go on to do that what they’ve always done. They go up, they go down, but over time the human race continues to progress and you are betting that that is going to continue.

So if one of the above strategies applies to and makes sense for you, consider taking action. But don’t “panic sell” because the markets are down. That is not a strategy, it’s an emotional reaction. As Jack Bogle famously said, “Don’t just do something, stand there!” Long-term investors should stay the course.