I’ve been thinking/reading/listening a lot lately about poverty and wealth inequality, particularly in America. This is (obviously) a moral issue, but it’s also an economic and governance issue as well because extreme inequality causes problems both economically and politically. I recently listened to a fascinating podcast episode with one possible solution to address the issue.

If you haven’t been listening to the Money with Katie podcast lately, you should. While the podcast hosted by Katie Gatti Tassin has always been interesting, she’s recently pivoted to doing more long-form, in-depth episodes on a single topic. She does extensive research and then brings in a really interesting guest expert to discuss the issue further. Her recent episode on Social Wealth Funds was fantastic and is really worth your time.

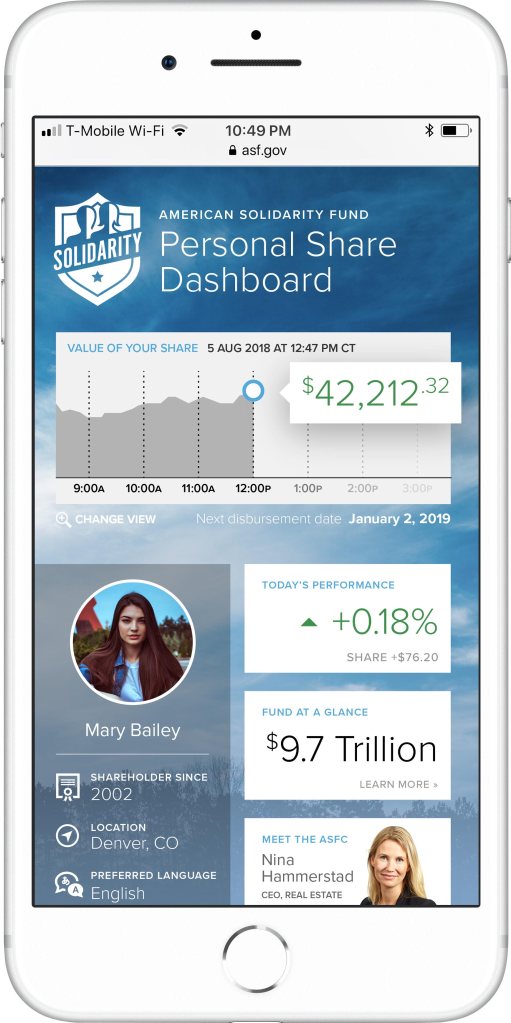

I can’t do the episode justice, so you should listen (and perhaps also read Matt Bruenig’s report), but I’ll try to give you a tease to get you to listen. A Social Wealth Fund is a slightly different take on a Sovereign Wealth Fund. The basic idea is to make every citizen of your country (in this case, America) a shareholder in a fund that invests in the broader markets. This fund then pays a Universal Basic Dividend. The UBD is similar in concept to a Universal Basic Income, but is based on the growth and dividends of the Social Wealth Fund. This is not just theory, similar ideas are already in place and working well in Norway and Alaska.

There’s a lot to like about this idea, as the goal is to raise the “floor” economic level that we are willing to accept as a society, while decreasing the “ceiling” for the very wealthy by only a tiny amount. It also gets around many of the practical problems of implementing a wealth tax (difficult to assess actual wealth, difficult practically to collect it, impacts on the economy and the market from generating the cash to be collected, wealthy people moving to another country, etc.) Instead, through a variety of processes, the Social Wealth Fund invests in companies through the market and ends up sharing in the economic growth of the country (and the world). Every citizen holds one share in the Social Wealth Fund and gets paid a dividend each year. There are a variety of ways to calculate that dividend, but it likely would be based on the current value of the Social Wealth Fund smoothed out over five years or so (similar to the way many pensions calculate their actuarial value).

Over time the Fund would grow by adding more assets (and by the growth of the assets themselves), giving more ownership to all of the people, yet still leaving a wide margin for private investing/wealth creation/free markets. (And, of course, because the Fund is investing in the market, it is still a very “capitalist” approach.) Bruenig’s approach (which is just an initial suggestion) takes Norway’s and Alaska’s models and improves on them in both small and larger ways. He still believes that for a variety of reasons there should be separate policies and funding for both children and elderly folks (Social Security), but everyone would still be a shareholder in the Social Wealth Fund, and it would serve as a way to boost people out of poverty.

As I was thinking about this after listening to the episode, it struck me that in some ways you could think about this as a “4% Rule for America.” If you aren’t familiar, the 4% “rule” (more of a guideline) is based on research that shows that in retirement you can generally withdraw 4% of the initial value of your portfolio in the first year, and then continue to withdraw that amount (adjusted up for inflation each year) indefinitely without ever running out of money (“ever” being defined as 30 years of retirement in the study). While it’s not a hard-and-fast rule, it is a pretty robust starting point for thinking about how much you can safely withdraw in retirement.

The UBD that an American Social Wealth Fund provides would be, essentially, a 4% rule for all Americans, except that through the various funding mechanisms the fund itself would continue to grow, and therefore the UBD would likely increase by more than inflation in most years. At some point the Fund would likely grow to enough ownership of the market that some folks might get nervous, at which time it would likely be capped (stop adding new assets) and then going forward would likely be pretty close to the 4% plus inflation amount. Katie and Matt discuss the idea of capping the fund and how that cap may be much higher than some people think because there are already hundreds of Sovereign Wealth Funds around the globe, so effectively you have lots of folks “making the market” by trading against each other; and you can even set up separate funds managed by different folks within one country to trade against each other.

Overall, I think it’s a fascinating – and very promising – idea, and I hope you take the time to learn more about it.