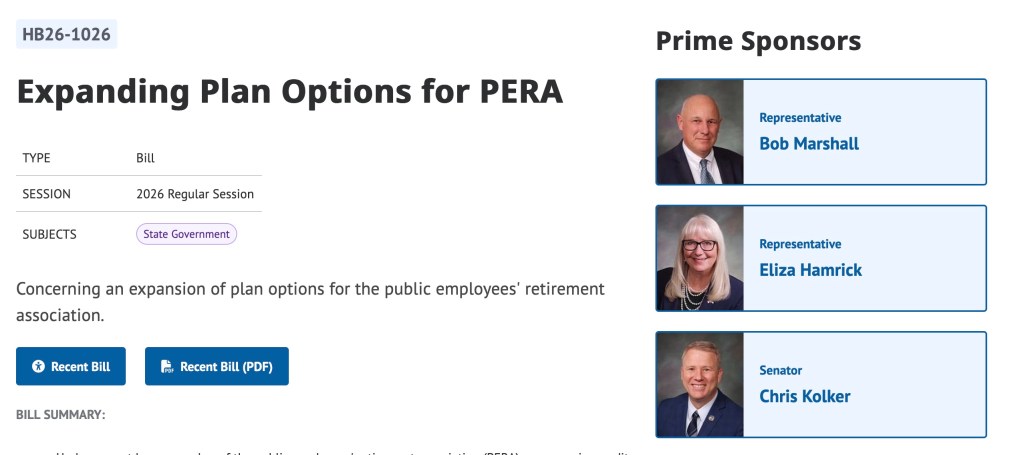

Back in 2023 I wrote a post about some suggested legislation I would like to see regarding Colorado PERA. I’m excited to share that this legislation has now been proposed as part of the 2026 Colorado General Assembly. It is House Bill 26-1026 sponsored by Representative Bob Marshall, Representative Eliza Hamrick, and Senator Chris Kolker. I would ask all Coloradans reading this, and especially Colorado PERA members, to contact their state legislators and ask them to support and vote in favor of this bill.

This bill proposes three changes to PERA (as well as cleans up some old language). It’s important to note that all three changes benefit PERA members without costing the state or PERA employers anything, nor would they impact PERA’s funded status. In other words, they are bills that would do tremendous good but cost nothing.

- Purchasing PERA Service Credit

PERA members are currently allowed to purchase service credit (pdf) if they are eligible. For those hired after January 1, 1999, they are eligible to purchase up to five years of nonqualified credit (non-public service) and up to ten years total (including other public service). This means that some folks who worked at, say McDonald’s (just as an example), for enough hours during high school and college might be able to purchase five years of nonqualified credit. Which is great, and this doesn’t change that. But a PERA member who takes five years off to stay at home with their children, or perhaps to care for an elderly parent, is not eligible to purchase those years because it’s not considered “work.”

The vast majority of PERA members who take time off to stay home with young children or to care for aging parents are women. Staying home for a number of years can end up having a dramatic effect on their future retirement security and the age at which they can retire. This bill would allow PERA members to purchase up to five years of this “noncovered” time (as long as it occurred after the age of 21). Some other pension systems also offer this and refer to this as “Air Time”.

Please note that purchasing service credit is actuarially neutral, it has no effect on PERA’s funded status and requires no additional funding from the state legislature. Yet it would have a huge positive impact on the retirement security of some PERA members and would also communicate that we value raising children and taking care of elderly parents as much as we value working at McDonald’s. - PERA’s 401k Plan

PERA employers are currently required by state law to offer the pre-tax version of PERA’s 401k to all employees, but employers have to opt-in to the Roth version. While many PERA employers do, unfortunately not all of them do. Often it is the smaller employers, like rural school districts, that don’t offer the Roth version of the 401k.

The reason this is a concern is because it can have a serious negative impact on PERA members. Many employers who don’t offer the Roth version of PERA’s 401k do offer plans from 403b vendors. Unfortunately, those plans are sold by so-called “advisors” (really, sales people) who have no fiduciary duty to PERA members. As a result, many of these plans have outrageous fees attached to them, often in excess of 2%, that can cost PERA members hundreds of thousands of dollars over their careers. And even some of the larger employers like DPS, Cherry Creek, and Aurora who have put their 403b plans out to bid, end up with plans that are better than the standard 403b offerings, but still are two to five times more expensive than PERA’s 401k plan, costing PERA members tens of thousands of dollars and subjecting them to possible cross-selling of dubious high-cost insurance products.

Here’s an example that compares investing in the Target Date fund in PERA’s 401k versus investing in the Target Date fund (same target year) in an AXA/Equitable 403b plan, which is a very common vendor offered in Colorado school districts. Let’s look at a teacher who contributes $500 a month to their retirement account for 30 years and we’ll assume a 7% return. They would end up with about $180,000 less in their Equitable 403b than in PERA’s 401k after 30 years, even though they were invested in exactly the same target date. But, as you know, investing doesn’t stop at 30 years, what about after 40 years, when a career-teacher might be age 63 or so. They’d have about $500,000 less in their Equitable 403b than their PERA 401k, again invested in the same target date. What about 50 years, think about a career teacher waiting until RMDs kick in to start withdrawing. It’s a difference of about $1.2 million.

This Bill would require all PERA employers to offer PERA’s Roth 401k (in addition to the pre-tax 401k that they already must offer). Again, note that this is at no cost to the employer (or to the state of Colorado or to PERA itself) and simply requires a little bit of staff time to configure their existing payroll software. It also does not preclude those employers offering additional 403b plans. - PERA’s 457 Plan

PERA also offers a 457b plan, but PERA employers currently have to opt-in to this plan (much like they have to opt-in to PERA’s 401k Roth). Again, many employers do, but not all. Again, often it is the smaller employers, like rural school districts, that don’t offer it, but it can also include larger employers like Denver Public Schools and Douglas County Public Schools, neither of which offer PERA’s 457b plan. The 457b plan is an excellent addition to the 401k plan, as it gives PERA members an additional bucket to contribute to above and beyond the 401k, and it also offers members the ability to access their pre-tax funds prior to age 59.5 if they leave their employer.

This also gives PERA members an additional low-cost option compared to the current 403b and 457b plans that might be offered by their employer, which often have those much higher fees described above. Again, this is at no cost to the employer (just a little bit of staff time to configure their payroll software) and no cost to the state of Colorado or to PERA itself, yet could have a significant positive impact for many PERA members.

If you are a Coloradan, and especially if you are a Colorado PERA member, I urge you to reach out to your Colorado state legislators and ask them to support and vote for this bill. You might also consider signing up for public comment for the PERA Board Meeting that takes place on January 23rd and asking PERA’s Board to vote to support this legislation. Public comment is at 8:30 am and you can do it in person or via phone. I have made public comments multiple times via phone and it’s simple and easy (and will be making a public comment about this bill at this meeting). If you aren’t available at that time to make public comment, you can also email the Board of Trustees at boardquestions@copera.org.

I’m hopeful that this legislation will pass as it will provide some significant benefits to many PERA members, but the more of us who contact our legislators and/or the Board, the more likely it is to pass. Thank you for considering taking the time to do this.