As we are about to turn the page (click the arrow?) on the calendar to move into 2026, there are many changes that happen around taxes. These include tax bracket changes, changes in the limits of what you can contribute to various retirement accounts, and a variety of other changes. The following is by no … Continue reading 2026: New Year, New Limits

Category: health_insurance

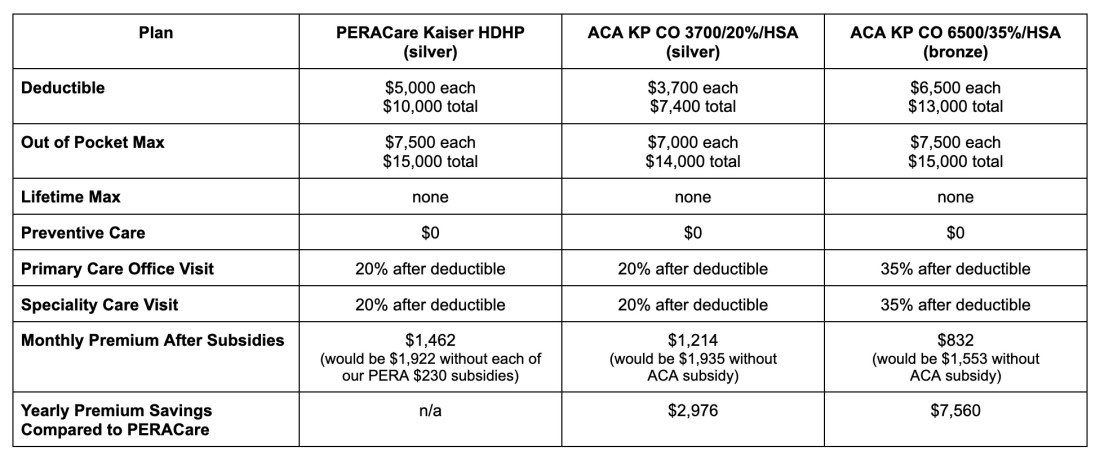

PERACare vs. ACA Marketplace: 2026 Edition

I've written previously comparing our options for health insurance in retirement (2024, 2025). In both years insurance through the ACA Marketplace was easily the better choice. But for 2026 there are big changes to both PERACare and the ACA Marketplace that are going to make the comparison much closer (and more complicated). The big change … Continue reading PERACare vs. ACA Marketplace: 2026 Edition

PERACare Premium Increases and the Impact of a Plan Design Change

Colorado PERA offers optional health insurance called PERACare as a benefit to its retirees. While the details of next year's plans aren't out yet (open enrollment begins October 20th), a presentation at today's Board meeting shared the details on the premium increases (and a change in one of the plans offered). Given all that's going … Continue reading PERACare Premium Increases and the Impact of a Plan Design Change

Podcast Episode 16: Health Insurance in Retirement

I just released Episode 16 of the Teaching You To Fisch podcast. This episode explores your choices for health insurance in retirement and gives you some suggestions on how to think about and evaluate them. Slides Transcript It's available on Spotify, Apple Podcasts, and YouTube, and I've also embedded it below. As always, feedback is … Continue reading Podcast Episode 16: Health Insurance in Retirement

You Can Contribute Directly to Your HSA

I've written previously about the advantages of an Health Savings Account (HSA) account, particularly if you can afford to not reimburse yourself right away and instead use it as a stealth retirement account. The usual (and best) way to contribute to your HSA is through payroll deduction. That way it not only comes out pre-tax, … Continue reading You Can Contribute Directly to Your HSA

PERACare vs. ACA Marketplace: 2025 Edition

I've written previously about health insurance in retirement (and 2024 post) for members of Colorado PERA. As we are now in open enrollment for 2025, I thought I would update with 2025 numbers. But first, a little background. PERACare is health insurance that PERA retirees can get through PERA. It is guaranteed issuance (which was … Continue reading PERACare vs. ACA Marketplace: 2025 Edition