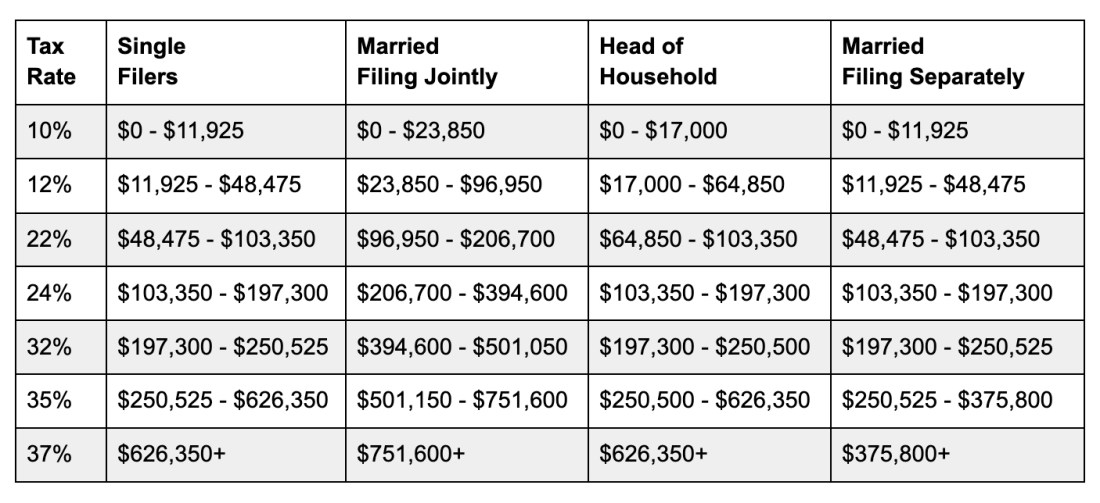

Updated July 2025 to reflect changes in the standard deduction and the bonus deduction for those over age 65 (due to legislation). As we are about to turn the page (click the arrow?) on the calendar to move into 2025, there are many changes that happen around taxes. These include tax bracket changes, changes in … Continue reading 2025: New Year, New Limits

Category: taxes

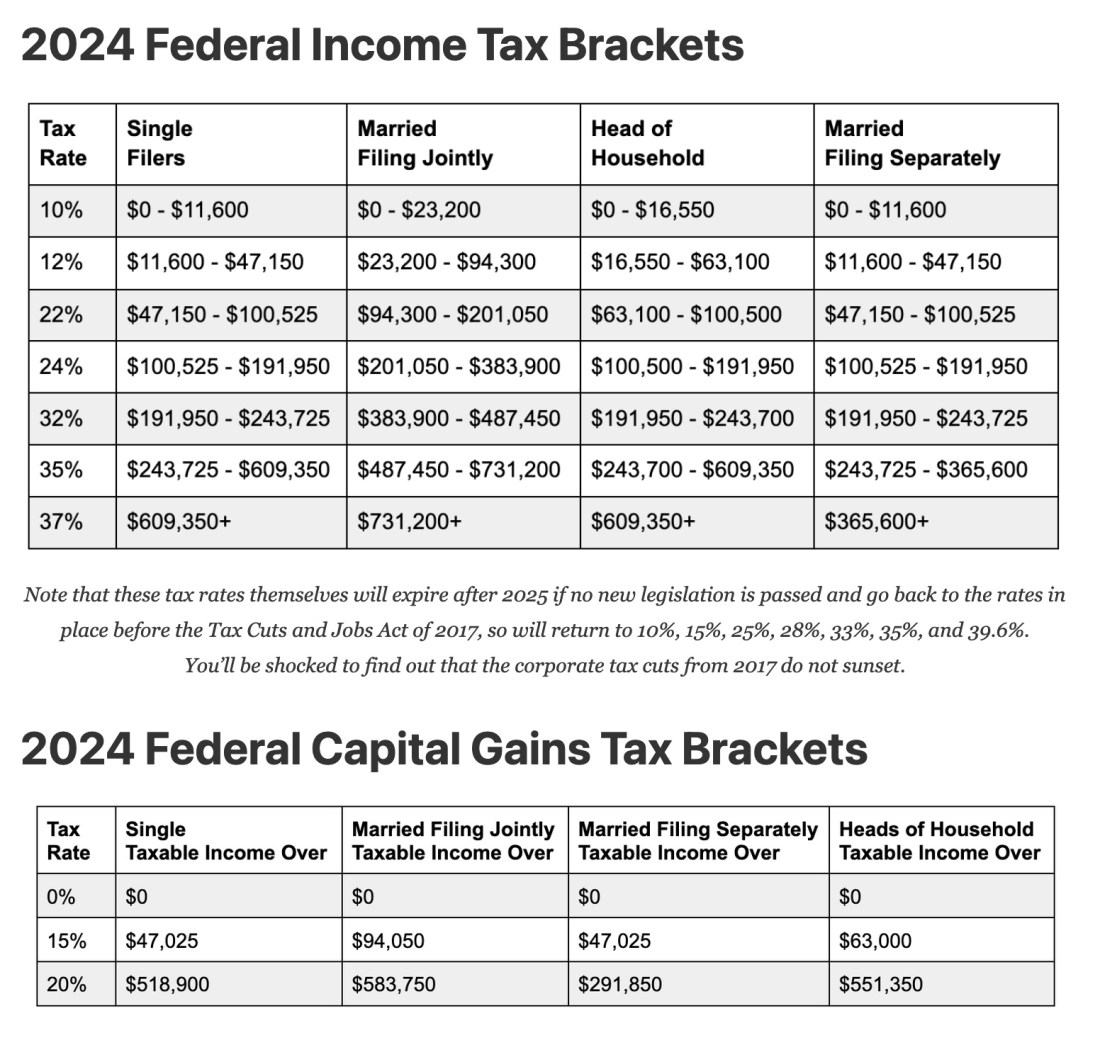

Taxing Capital Gains: Current Law and Some Interesting Proposals

There has been lots of chatter lately about some proposals around changing how we tax capital gains, and especially around a proposal to tax unrealized capital gains. This is due to the Harris/Walz campaign saying they generally support the proposals that the Biden Administration included in their Fiscal Year 2025 Revenue Proposals. To be clear, … Continue reading Taxing Capital Gains: Current Law and Some Interesting Proposals

Coloradans Can Buy a Used Tesla Model 3 for as low as $13,000

Yeah, I know, I write about EVs a lot for a blog focused on financial literacy for educators. Part of that reason is because of the climate emergency we are presently in that I think we should all be urgently addressing. But, even ignoring the climate emergency, EVs are just way more efficient, less hassle … Continue reading Coloradans Can Buy a Used Tesla Model 3 for as low as $13,000

Paying Your Property Taxes with a Credit Card

Our 2023 property taxes on our house were due in April. As I've written about previously, property taxes in Colorado are actually very low when compared to other states, but that doesn't mean they aren't a significant expense (ours were $5571 for 2023). I always used to pay these by electronically paying from my bank … Continue reading Paying Your Property Taxes with a Credit Card

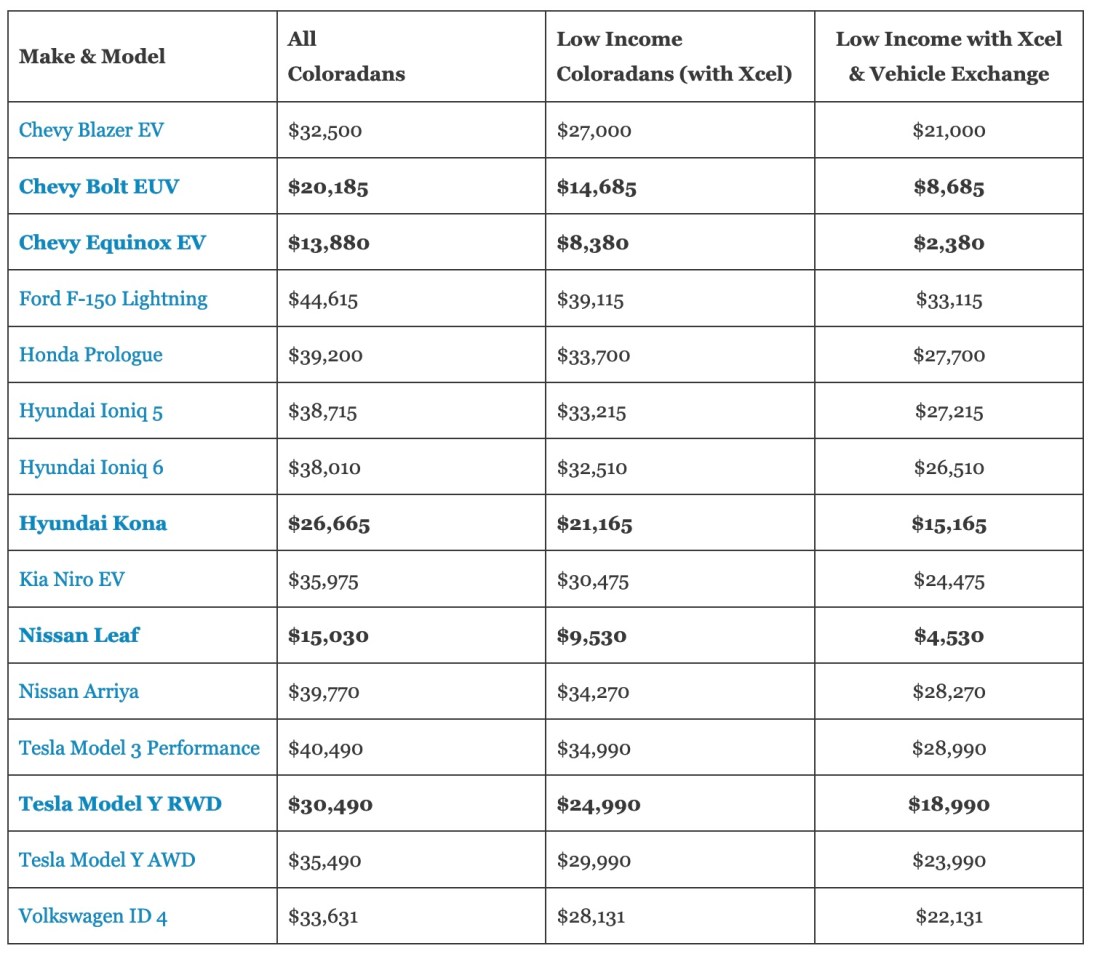

Low Income Coloradans Can Save Up to $26,500 on a New EV

I've written previously about the great incentives Coloradans have to purchase an electric vehicle. It just got even better for low-income Coloradans: an additional $5,500 rebate from Xcel Energy. While many readers of this blog may not qualify (because your income is too high), some of you might. And almost all of you will know … Continue reading Low Income Coloradans Can Save Up to $26,500 on a New EV

Colorado’s E-Bike Tax Credit Begins!

Starting April 1, 2024 (that's tomorrow if you're reading this the same day I post it), all Coloradans will qualify for a $450 tax credit (applied at the time of purchase) for eligible e-bikes. There are some minor restrictions: the bike has to be UL-certified, you must purchase from a registered Colorado e-bike retailer (which … Continue reading Colorado’s E-Bike Tax Credit Begins!