In my last post I suggested that personal finance isn’t really all that complicated and that, in fact, I could summarize it in one sentence. But I also indicated that there is still a lot to learn, especially if you want to optimize. So this post is going the other direction, into the weeds a bit, and focuses on one particular way to optimize: harvesting capital gains.

First, some background. When you own investments in a taxable account and the share price goes up, it’s called a capital gain (if it goes down, it’s a capital loss). But unless you sell some shares, these gains (or losses) are unrealized, which means they aren’t taxable yet. This is a great advantage for everyone (but especially for the wealthy) as you can let your gains run for years and years and years and not pay taxes. (And, if don’t ever have to sell it, then at your death they get a “step-up in basis” which means your heirs will be able to sell and those gains will never be taxed.)

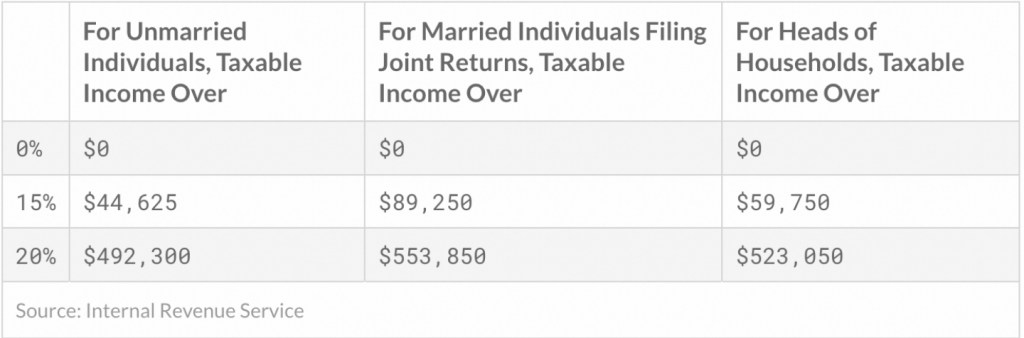

But if you do sell, there are two kinds of capital gains: short-term and long-term. If you’ve owned a particular share for longer than one year, it’s considered a long-term capital gain. Less than one year, a short-term capital gain. Short-term capital gains are taxed as ordinary income, but long-term capital gains get special (better) treatment. Here are the capital gains tax brackets for 2023 (just like ordinary income tax brackets, these are adjusted each year). As you can see, these tax rates are more favorable than for ordinary income.

Most of what you will hear about when talking about capital gains is tax-loss harvesting, which is when you sell your shares at a loss and can use those losses to either offset other capital gains or up to $3,000 in ordinary income. But some folks can actually do the opposite, sell for a gain and harvest those gains, particularly if they can manage to stay within the 0% capital gains tax bracket (which means they will owe $0 taxes on the gain).

I’ve written before about how my daughter started a Roth IRA as soon as she had earned income and that we encouraged this by providing matching funds (much like some employers might). She how also has access to a 401k and a 457b, so we are also matching her contributions to those. But, as I’ve mentioned previously, there’s a third “asset location” to consider. While tax-advantaged accounts like IRAs, 401ks, 403bs, 457bs can be either pre-tax (traditional) or post-tax (Roth), most people will also want to have some money in a taxable brokerage account. Why? Because those other accounts are designed for retirement, so you typically have limited access to that money before age 59.5. In our daughter’s case, she may want to do something like buy a house, or a car, or take a fabulous trip, or pay for her parents to take a fabulous trip :-), or some other large expense sometime between now and retirement. So, in addition to her savings, it makes sense for her to also invest for the more “medium term” in a taxable brokerage account.

Just like with all the other accounts, we’ve matched her contributions here as well. With the recent rise in the markets (as well as some luck in terms of when those contributions were made), she had about $2,100 in unrealized capital gains in her taxable account (roughly $800 short-term gains and $1,300 long-term gains). But she just graduated from college and her taxable income this year is not going to be huge, and should definitely come in below the $44,625 that would put her into the 15% capital gains tax bracket (note that you do need to add any capital gains to your ordinary income and stay below that $44,625).

So we sold her holdings. Even though we had no need to and normally we are buy-and-hold forever kind of folks. But we sold because we wanted to realize those capital gains, because those long-term gains will end up being taxed at 0% (so not taxed), and her short-term gains are likely to not be taxed at all (or might end up being taxed at 10%). So we sold, waited for the funds to settle, and then re-bought.

Note: For capital losses, you have to pay attention to the wash-sale rule, but not for capital gains.

Her balance is essentially the same as before, but her cost-basis is now reset at the higher level. Which means that, some time in the future when she might choose to sell and she will owe taxes, there will be $2,100 less in gains to be taxed.

Now, is this a huge deal? No. The $800 in short-term gains would’ve turned into long-term gains in the future, so basically we can think of the full $2,100 as future long-term gains that we’ve avoided. If the tax laws stay the same, then in the future she will likely be in the 15% capital gains bracket, so $2,100 times 15% is $315 in tax savings. Definitely not huge, but part of being successful financially (especially for those who are not wealthy) is stringing together a bunch of “small wins” that, over time, end up making you much more financially secure. This was one such small win that took about 15 minutes to accomplish. (Although writing the blog post took longer :-).

Hi Karl,

I’m a teacher in Cherry Creek and I took your Financial Literacy class over the summer. I was wondering what you know about the programs for teachers looking to buy a home. Are there really home loans specifically for teachers? Are they good deals? Any knowledge you have to share would be great!

Thank you,

Lori Rosenberger

LikeLike

I don’t know much about it, but here are some links that might be of interest:

https://www.hud.gov/program_offices/housing/sfh/reo/goodn/gnndabot

https://www.bankrate.com/mortgages/colorado-first-time-homebuyer-assistance-programs/

https://www.hud.gov/states/colorado/homeownership/buyingprgms

https://dhcd.dc.gov/eahp

LikeLike