I was interviewed today by a journalist about 403b plans in general and specifically about the NEA InvestMyself 403b offered in partnership with Security Benefit. I don’t know if and when the article will be published, or if anything I said will end up in it, but thought I might as well go ahead and share a few thoughts here for those who might be interested.

As Scott has written, NEA has replaced it’s previous 403b program called “Direct Invest” with a new program named “InvestMyself“. As before, this is a partnership with Security Benefit, which is an insurance company that has long offered 403b plans (as well as other products). NEA receives an annual fee (currently $3.8 million) from Security Benefit for the exclusive right to market their products to NEA members. NEA doesn’t offer the 403b, Security Benefit does and, as far as I can tell, NEA’s sole role is to (presumably) negotiate the fees and to help Security Benefit market it.

InvestMyself is actually a pretty good product and is much better than most 403bs offered in the K-12 space. There is a fixed $35 annual charge on accounts with balances of less than $50,000, and a 0.30% administrative fee assessed to your balance which is capped at $500 annually (which equates to a balance of $166,667 or higher). They offer a limited number, but good selection, of low-cost Vanguard funds include Target Date Funds.

So you can invest in the Vanguard Total Stock Market Index Fund for 0.34% plus $35 annually if your balance is less than $50,000 (and any balance over $166,667 would only be 0.08% of your balance plus the $500 capped fee for admin). Or in a Target Date fund for 0.38%. That’s pretty good in comparison to most 403bs, although still more expensive than the best 403bs from places like Vanguard and Fidelity, or from many state 457b offerings (like PERA’s 401k and 457b in Colorado). I particularly like that they phase out the $35 annual fee for higher balances (as they should) and that they cap the 0.30% percentage admin fee at a max of $500 (as they should).

But here’s the concern. Security Benefit doesn’t really market InvestMyself, nor make it particular easy to find out about. Anecdotally as least, the sales reps from Security Benefit do not mention it to prospective clients and, at least on a few occasions, claim not to have heard of it when asked about it. (Again, anecdotally, I have talked with over a dozen Colorado educators who have their 403b with Security Benefit and none of them had InvestMyself or had heard of it.) It would be really interesting to have the data on what percent of school district members who use Security Benefit are in InvestMyself vs. what percent are in the regular product. To be clear, I don’t know the answer to this, but I suspect the percent in InvestMyself is very, very small (like 1-2% at most). Which means everyone else is in Security Benefit’s regular 403b product which is horrible. (Here’s one example, although like many 403b companies, they have multiple similarly named products so it’s very confusing – likely on purpose.)

Again, I don’t know this, but from afar it appears like a bait-and-switch. NEA agrees to let Security Benefit use their name (effectively endorsing them), and instead of getting the good InvestMyself product they get the horrible, high fee regular Security Benefit product. (Even with the good InvestMyself product, educators will likely be sold on other high-cost financial products offered by Security Benefit).

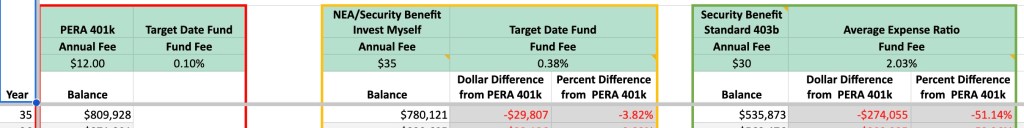

So what does this look like in dollars and cents? Here’s the spreadsheet. This compares PERA’s 401k plan (available to all public employers in Colorado), InvestMyself through Security Benefit, and one of Security Benefit’s standard 403b offerings. As you can see, InvestMyself is not bad (although still not as good as PERA, as over time you will have tens of thousands of dollars less). But when you compare to Security Benefit’s regular 403b program, the difference is hundreds of thousands of dollars over time (and conceivably over $1 million). Here’s what it looks like after 35 years (assuming 7% annual return and $500/month contribution).

So, if you have Security Benefit currently (or as an option in your district), and you don’t have any better options (Vanguard, Fidelity, a state 401k or 457b like PERA offers in Colorado), then contact them and switch to InvestMyself. One question I have not found the answer to is that if you are currently invested in Security Benefit’s traditional offering which often has surrender fees (on a rolling basis from the time of each contribution – yuck!), do they still charge you the surrender fees if you switch to InvestMyself. I suspect they do, but I hope not.

But what about the larger issue of NEA “selling” its endorsement for $3.8 million a year for a pretty good product, but one that likely doesn’t actually get sold very often to NEA members? If NEA is going to partner with somebody, partner with a Vanguard or a Fidelity, where you don’t have the possibilities of a bait-and-switch and you won’t get cross-sold other dubious, high-cost financial products.

But, honestly, I don’t think NEA should be partnering with anyone. 403b-land is not their wheelhouse and there is no need to partner with anyone. Instead, they should focus their efforts on two things in this space:

- Help educate their members around financial literacy in general, including investing in things like 403b plans and the effect of fees, but also educating them about all the other aspects of financial literacy, with a particular emphasis on their pension plan and their employer benefits. (Hey, that sounds like the class I teach!)

- Work with their local unions to make sure that every school district offers only good 403bs and 457bs (or 401ks in a few states that offer them) and then provide education around how to choose your asset allocation. In some states, including Colorado, there’s no reason for a school district to offer any 403bs, as they have better 401k and 457b options already available to them. But, for states that don’t offer those, then work with districts to offer Vanguard, Fidelity or one of the other good vendors (or opt-in to the state 457b plan for those districts that have not).

I doubt this post (or the article if and when it comes out) will have any effect. But if you are a member of NEA, and especially if you are in any kind of leadership role, please consider having these discussions with NEA leadership. I think this is an easy way for NEA to really improve the lives of its members at no cost to NEA. Well, other than losing the endorsement deal, but this would be in the best interests of its members. Isn’t the best interest of its members the entire reason NEA exists?

Update 12-12-23: The article was published. I wish the author had been more clear about two things. First, that the InvestMyself product itself is actually pretty good. Second, that it’s not NEA’s or Security Benefit’s “fault” that 403bs aren’t covered by ERISA. That’s federal legislation.

Just finished this process. Your assessment is accurate. They don’t want anybody finding out about this program!!! Past lawsuits have coerced them into making this available. They collude with the NEA, while the NEA takes in a few million and doesn’t represent their members interests at all. Borderline a crime and any fiduciary should be prosecuted for putting you in a “regular”- costly 403B account if this is available. The program itself is the best you’ll do. 403B’s are horrible in general. I hate the NEA and Security Benefit. Next year I am not paying my fees to this union. They do nothing for us. Every year a raise below the COA, healthcare goes up. I have to live a “cheaper” lifestyle every year I work while being fleeced by a political union that has no interest in helping it’s members..I am working on exposing this as much as possible

LikeLike

Hi Patrick. I am sharing your same sentiment, and I was wondering if you were ever able to open an Invest Myself account. I have gotten the run around from NEA and Security Benefit, with a Security Benefit advisor trying to sell me on another 403b plan, after I told him I wanted the Invest Myself option. Then, he told me he had no idea what that option was and is not familiar at all! I am wondering if signing up for it is even possible – my district says they can’t help either!

Were you ever able to sign up? If so, I would love to connect and figure out how you did it!

LikeLike