I’ve written previously about why Coloradans who are in the market for a new car should really consider an EV, due to the up to $7,500 federal tax credit and the $5,000 Colorado state tax credit (some restrictions apply on the federal tax credit). That’s still true, but there are some changes that happened January 1, 2024, some of which are great and some of which are not as great.

The not so great news is that many of the EVs that qualified for the full $7,500 federal tax credit now only qualify for $3,750 or even $0 at the federal level. This is due to new requirements around battery and mineral sourcing in addition to the previous requirement of made in America. You can find the vehicles that still qualify for either the full $7,500 or $3,750 at this link, simply choose “January 1, 2024 or later” from the “Placed in Service” dropdown.

Note that as of this writing that the “January 1, 2024” choice is not present in the dropdown, but hopefully will be shortly. Also note that this list is updated as manufacturers provide updated information to the government, and as they change the sourcing of materials for the cars in order to requalify for the credit, so be sure to check back to see any updates.

The great news is that not only is Colorado’s $5,000 incentive unchanged, but there’s an additional $2,500 Colorado tax incentive (taking the Colorado incentive up to $7,500) for any new EV with an MSRP of $35,000 or less. While there currently are not that many of those out there (and especially not many that also qualify for the federal $7,500 tax credit), there is at least one: the Chevy Bolt EV (and EUV variant).

The bad news here is that GM stopped producing new Bolts in December, so there are only a limited number available (so you’ll need to act fast). (GM has plans to release a new Bolt based on their new battery platform, likely in 2025.) But, as of this writing, there are still over twenty each of the Bolt EV and Bolt EUV available in Colorado. When you take the combined $15,000 in tax incentives (Federal $7,500, regular Colorado $5,000, Colorado $2,500 for MSRP less than $35k), that means as of this writing you can get a new Bolt EV for as low as $15,000 and a new Bolt EUV for as low as $17,000 after tax incentives (and many for just a bit more than that). That means you are only paying roughly 50% of the full cost of the vehicle!

While I would not necessarily recommend either version of the Bolt as a road trip car (because the current Bolt battery platform has slower charging speeds which are not optimal for road trips), they are both excellent daily drivers (lots of range and charges fast enough at home from even a regular outlet for normal driving around town, no charger installation required). And not only are they not very expensive up front, but their total cost of ownership is also very low due to savings on “fuel” (electricity is much less expensive than gas) and maintenance (no oil changes!, plus pretty much the only regular maintenance is tires and windshield washer fluid.) So not only do you get the car for 50% off, but you’ll pay much less than you are used to operating it going forward.

While there will (fairly) soon be other good EVs with an MSRP of less than $35,000, right now this is likely to be the only one that qualifies for the full $15,000 in tax credits. And while there are many excellent EVs in the $35,000 to $50,000 range before incentives (especially the Tesla Model 3 and Model Y), until manufacturers adapt/build to the new regulations and requalify for the full $7,500 federal tax credit, they are much more expensive then they were through the end of 2023 (some trims of the Model 3 and Model Y will likely still qualify for the $3,750 or $7,500 federal tax credit after January 1st, but we don’t know for sure yet). But the Bolt, while it lasts, is an amazing deal for a great and efficient daily driver new car.

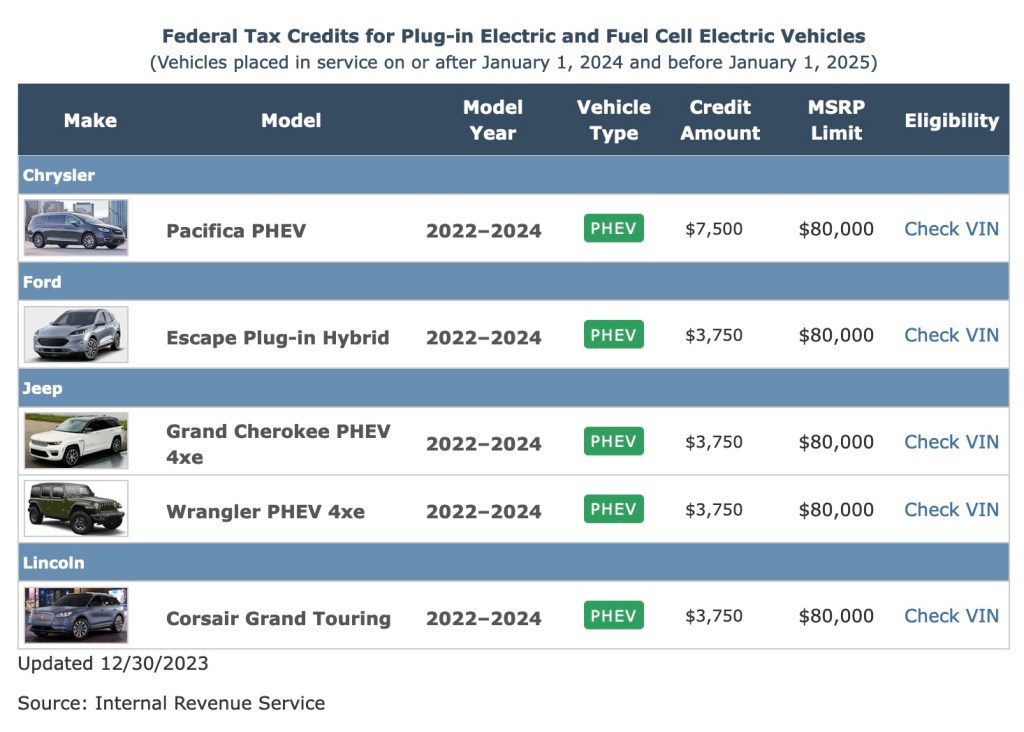

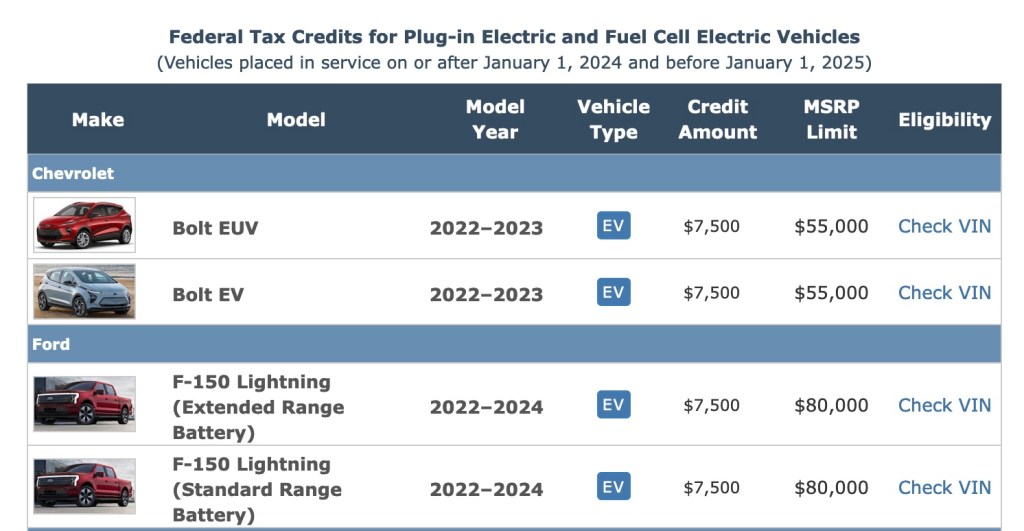

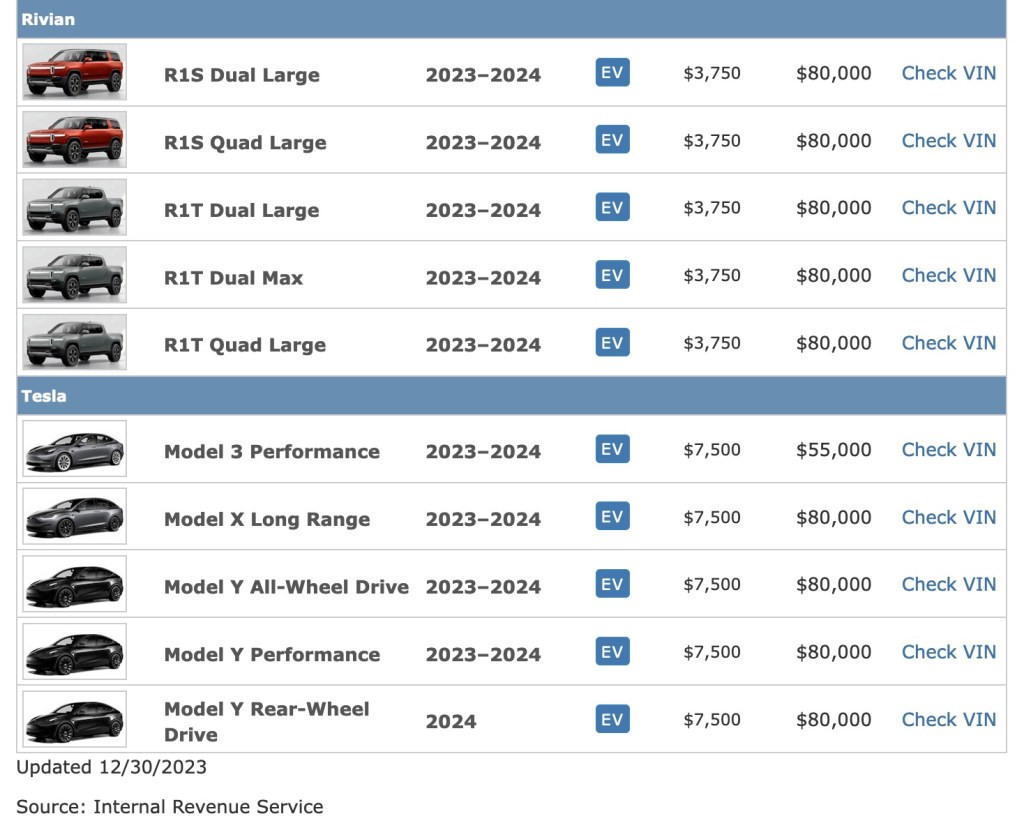

Update 1-1-24: The dropdown at the link has been updated for post January 1st, 2024 changes. Here are the vehicles currently eligible (again, I expect this list to grow some as manufacturers get updated info to the government). Notably, all trims of the Tesla Model Y still qualify for the full $7,500 credit.

All Electric

Plug-in Hybrids