As we are about to turn the page (click the arrow?) on the calendar to move into 2024, there are many changes that happen around taxes. These include tax bracket changes, changes in the limits of what you can contribute to various retirement accounts, and a variety of other changes. The following is by no means an exhaustive list, but I’ve tried to include the changes that I think are most likely to be useful for planning purposes to the readers of this blog. As always, I’m not a CPA, so check with a tax professional if you have any questions.

2024 Federal Income Tax Brackets

You’ll be shocked to find out that the corporate tax cuts from 2017 do not sunset.

2024 Federal Capital Gains Tax Brackets

2024 Federal Standard Deduction

2024 Roth IRA Income and Contribution Limits

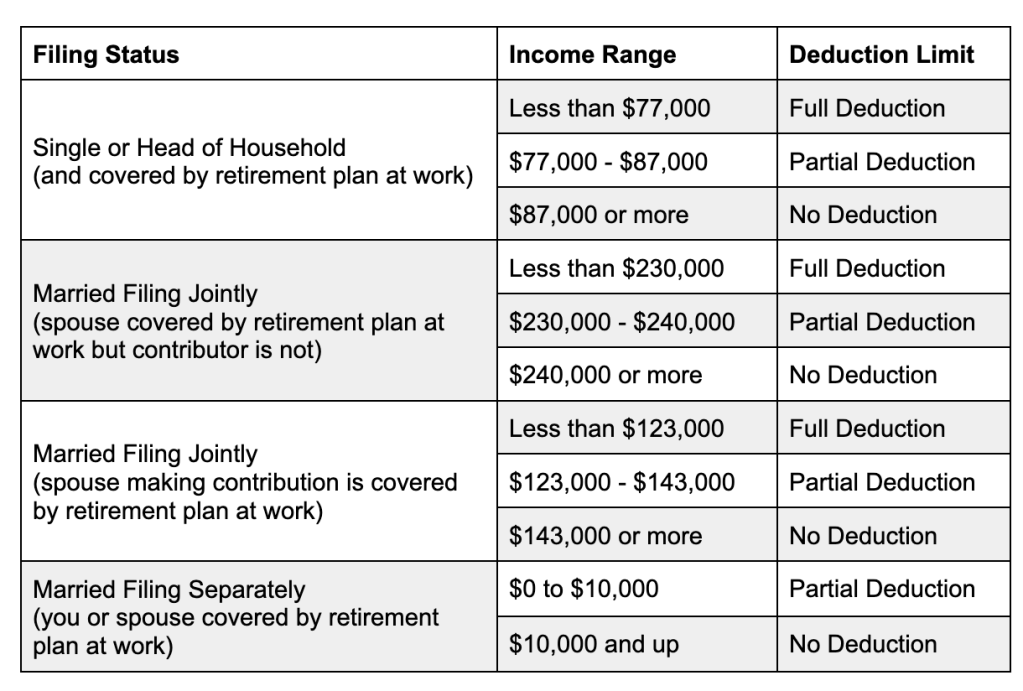

Traditional IRA Income and Contribution Limits

2024 Defined Contribution Limits (401k, 403b, 457)

2024 Health Savings Accounts (HSA)

2024 Health Flexible Spending Account (Health FSA & Limited Purpose FSA)

Dependent Care Flexible Spending Account

2024 Transportation Benefit Exclusion

2024 Medicare Premiums

2024 Education Tax Credits

Age for Required Minimum Distribution (RMD)

ACA Health Insurance Premium Subsidy

As part of the Inflation Reduction Act, the enhanced premium subsidy for health insurance through the ACA Marketplace was extended through 2025. Prior to the American Rescue Plan and now this extension, subsidies were limited to those with incomes up to 400% of the Federal Poverty Level. Currently, that income limit is waived and your premiums are limited to 8.5% of your Modified Adjusted Gross Income (MAGI).

Are There Changes You Can (Should) Make?

So now is a great time to evaluate all of the above areas that might apply to you and perhaps make some changes. It’s always a good idea to see if you can increase your contributions to retirement plans, your HSA, or your FSA, and as you start gathering all the info you need to complete your 2023 taxes, start thinking about ways you might be able to optimize your 2024 taxes.