I’ve written before about 401k, 403b, and 457b retirement plans and the similarities and differences between them. Unfortunately, many school districts offer some truly horrible 403b plans (listen to Learned by Being Burned for more info). But there has been a positive development lately in that some school districts, typically large ones, have now started to put their 403b plans out to bid, which often results in a much better choice for their employees. This usually also results in what’s known as “single-vendor”, meaning that the winner of the bid is the only 403b plan that can be offered in the district. Some folks see this as a negative (and 403b companies spend a ton of time and money trying to use that as an argument against it) but, when, done correctly, it is a huge win for school districts and their employees. (Ask yourself, how many private employers do you know who have multiple plan choices for their 401ks?)

Teachers in Colorado have the added benefit that all public school districts have to offer PERA’s excellent 401k plan (which uses the same tax “bucket” as the 403b), and they can choose to offer PERA’s excellent 457 plan (although unfortunately not all have opted in yet). At least two large school districts in Colorado have recently gone through this process, Cherry Creek and Denver Public Schools. I wrote about Denver Public Schools and Cherry Creek Public Schools recently, and now I have some information on Aurora Public Schools’ offering.

Aurora put out their plans to bid and went with Corebridge (formerly Valic, formerly AIG). Corebridge’s standard 403b plans are typically not very good, but that’s the beauty of bidding out your plan. Instead of getting the standard offerings from the 403b companies (which are usually bad), the bidding process forces the vendors to offer a better product. (Which begs the question, of course, of why they don’t simply offer their best product to begin with. But I digress.)

While I still would not have picked Corebridge given their history, their bidded plan offering (for Aurora Public Schools, at least) is better than their standard offering. They charge an administrative fee of 0.39% of assets under management. As far as I can tell, they do not charge a fixed quarterly or annual fee on top of that (but they don’t make it easy to find that, so it’s possible they do). So, for now, I’m assuming a $0 fixed fee. Then they offer the following choice of mutual funds. Here are the fund offerings and expense ratios, including the total expense ratio with the admin fee, with my recommendations in bold.

So, what’s the verdict? This is an okay plan, and better than the average 403b plan out there. Having said that, is this the plan that Aurora Public School educators should choose? No.

The reason is that Aurora Public School educators also have access to PERA’s 401k plan, which uses the same tax-deferred “bucket” as the 403b plan (and yet offers lower fees), and PERA’s 457b plan, which is a separate, additional “bucket” of contributions. PERA charges $12/year for the 401k and $18/year for the 457b (newer, smaller program than the 401k, that should come down to $12 when it grows enough). They also charge a 0.03% administrative fee. Here are the investment offerings in PERA’s 401k and 457b:

| Fund Name | Expense Ratio | Total with 0.03% Admin Fee |

| PERAdvantage Capital Preservation | 0.21% | 0.24% |

| PERAdvantage Fixed Income | 0.13% | 0.16% |

| PERAdvantage US Large Cap Stock | 0.05% | 0.08% |

| PERAdvantage US SMID Cap Stock | 0.15% | 0.18% |

| PERAdvantage International Stock | 0.27% | 0.30% |

| PERAdvantage Real Return | 0.17% | 0.20% |

| PERAdvantage SRI | 0.19% | 0.22% |

| PERAdvantage Target Date | 0.07% | 0.10% |

All of PERA’s investment choices are good and always have lower fees than the equivalent bidded Corebridge choice. (Each white label fund is a mix of active and passive and generally has outperformed the indexes over time.) So, while the bidded Corebridge 403b is okay, PERA is better. Let’s break out the spreadsheet. Again, bidded Corebridge does much better than most 403bs, but look at the differences over time. First, let’s look at choosing a target date fund (assuming a $500/month, $6,000/year contribution, and an assumed rate of return of 7%, you can adjust those numbers if you make a copy of the spreadsheet).

Note that this is assuming a $0 annual fixed charge for Corebridge, the differences are even larger if that is not actually the case.

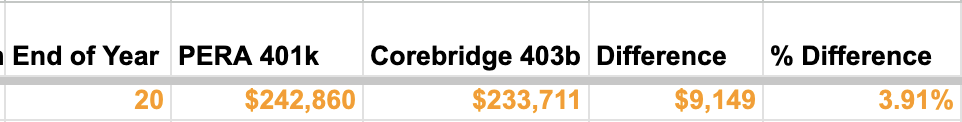

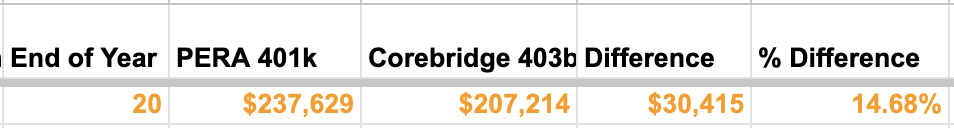

After 20 years…

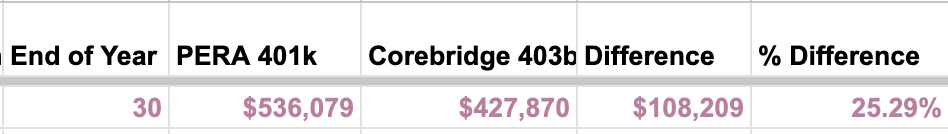

After 30 years…

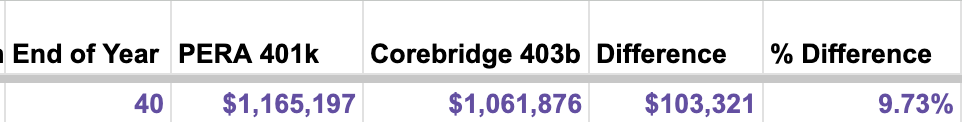

After 40 years… (yes, most folks may not work for 40 years, but their investment timeline is likely that long or longer)

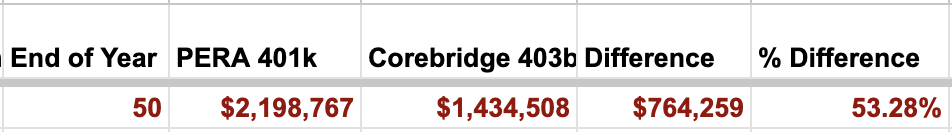

After 50 years… (think starting at age 25 and starting to take RMDs at 75)

Is that an astronomical difference, as it often is with non-bidded 403bs? No. But I think most folks would agree that that’s a significant amount of money just for choosing a different vendor.

Now let’s do the same if you compare the most expensive options that PERA and Corebridge offer.

Aurora Public School employees should clearly choose the PERA 401k over the Corebridge 403b, especially considering additional fees for other account activity (and possibly cross-selling of other products?). And, crucially, Aurora Public Schools should be providing this information to all employees (especially all new hires) up front. This would obviously be of great value to employees (and district staffers), but would also help with employee satisfaction and retention, which is a huge issue right now in K-12.

If you currently have money in a 403b in Aurora Public Schools (in Corebridge or in a previous 403b vendor), you have a few choices for what to do with the existing money (I would stop contributing new money and instead contribute it to PERA’s 401k or 457b.)

- First, as always, if you leave your employer, you can roll your 403b into an IRA at some place like Vanguard.

- Second, you can use the money in your 403b to purchase years with PERA if you are eligible to purchase years.

- If you can’t do either of those first two, then most likely the “new” Corebridge is better than your existing 403b choice. Check to be sure but, if it is, you can transfer your current 403b into the new Corebridge. Just make sure to only choose from the bolded investments.

While districts putting their 403b plans out to bid is definitely a positive for Colorado educators, as I’ve said before every Colorado district has the option of offering both PERA’s 401k and 457b (at no charge to the district) which is consistently a better choice, there is no profit motive, and there is no need at all to complicate things with 403b choices at all. I really wish all Colorado districts would go single vendor: with PERA.

3 thoughts on “Aurora Public Schools Single-Vendor 403b Plan: Is It The Best Choice?”