Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I’ve created to illustrate particular topics. Some of them are modifications of spreadsheets I’ve used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really missing out, of course), I decided I also should make individual blogs posts that just highlight the spreadsheets. That way some folks may be able to use them who otherwise wouldn’t bother with the podcast.

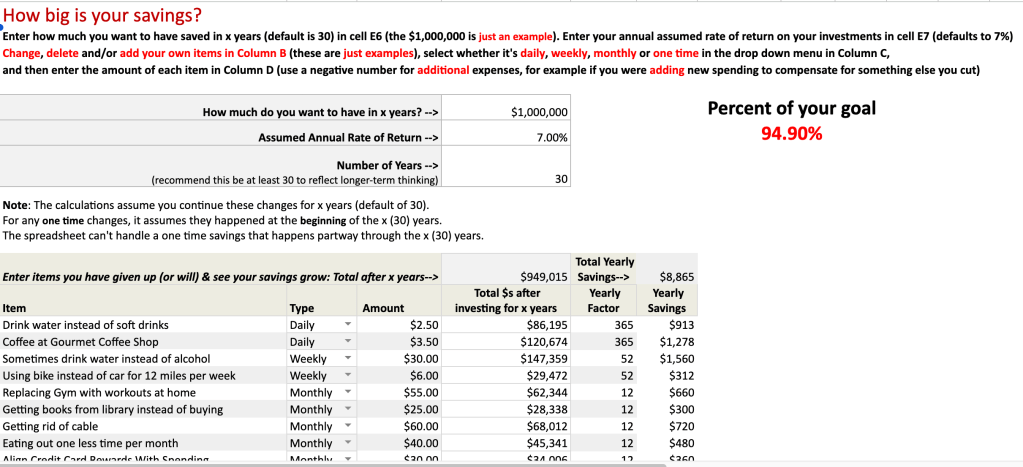

The first spreadsheet is a Growth of Savings Calculator (when you click on the link it will ask if you want to make a copy, click “Make a copy” to get an editable version). The basic idea is that you can go through your bank statements and/or credit card statements and identify some items that you are spending money on that don’t fully align with your values and goals, and that you could perhaps cut back on or give up altogether. It then allows you to enter those items, their cost, and the frequency that you pay for them, and the spreadsheet will not only calculate your yearly savings, but how much that will grow to if you invest those savings over time (with a default of 30 years). The spreadsheet has some sample items already listed, but you will want to modify some of them to match your situation, remove some of them altogether because they don’t apply to you and, crucially, add some of your own as these are just sample items and you presumably have items individual to you that aren’t currently listed.

If you want a more detailed walk through of how to use the spreadsheet, this links directly to the specific spot in Episode 3 where I illustrate how to use it (roughly from 5:08 to 9:37 of the video). This exercise illustrates how even seemingly small spending decisions can amount not only to significant savings but, when invested, can grow into truly impressive amounts.