Colorado PERA offers optional health insurance called PERACare as a benefit to its retirees. While the details of next year’s plans aren’t out yet (open enrollment begins October 20th), a presentation at today’s Board meeting shared the details on the premium increases (and a change in one of the plans offered). Given all that’s going on in the health insurance space (new Administration in Washington, new Secretary of Health and Human Services, changes to the CDC and FDA, changes to the ACA, etc.) , it’s no surprise that there are significant premium increases.

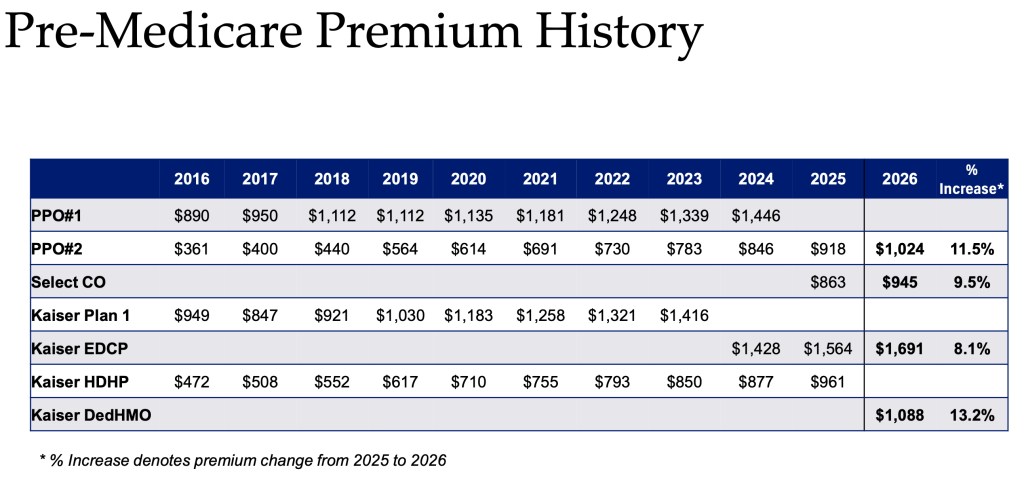

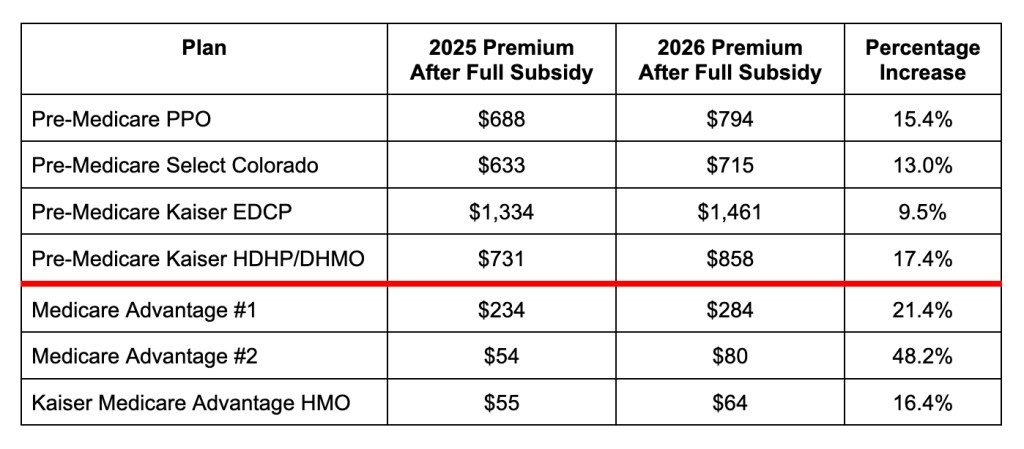

Here are the premium increases for both the pre-Medicare and Medicare Advantage plans that PERA offers.

As you can see, those are some pretty hefty increases, ranging from 8.1% to 13.2% on the pre-Medicare side, and 5.3% to 15.4% on the Medicare side. But those percentages are actually underestimating the increases because they don’t factor in the premium subsidy that PERA retirees receive.

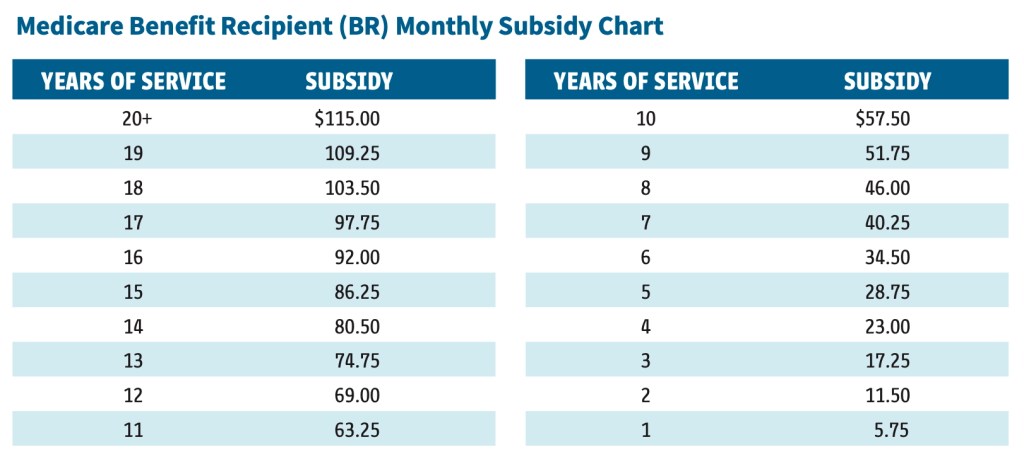

PERA retirees receive a subsidy of up to $230 for pre-Medicare and up to $115 for Medicare depending on years of service (maxing out at 20 years of service).

So these are the actual percentage increases for PERA retirees who have 20 or more years of service as a percentage of what they were paying versus what they will be paying.

One can certainly argue that those percentages are overstating it (especially for Medicare as the premiums are so much lower overall), but I think these are still the percentages that are most accurate to the members (at least those with the full subsidy). They care about the percentage increase for them.

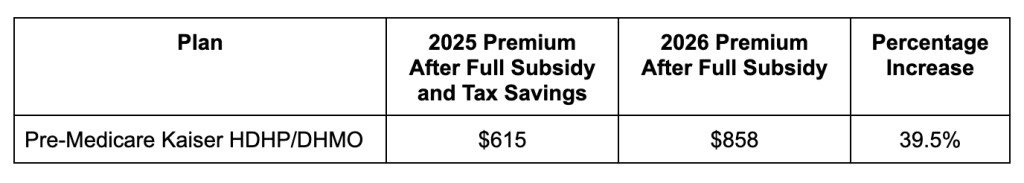

But the impetus for this post is actually more than just the premium increases, it is the one plan design change for the pre-Medicare offers. Previously one of the choices was an HSA-qualified High Deductible Health Plan (HDHP) and that choice will now be a Deductible HMO (DHMO). As you can see from the chart, the premium increase for someone on that plan (who has the full subsidy) is 17.4%. But, again, I think that is understating it because it ignores the fact that these folks are also losing the ability to contribute to a Health Savings Account (HSA). Since almost all of these folks are over age 55, the maximum contribution for 2025 is $5,300 (it likely will be slightly higher in 2026, but I’ll use the 2025 number). This is relevant because HSA contributions are pre-tax, so by PERA no longer offering an HSA-qualified HDHP these PERA members are losing out on significant tax savings as well. Someone in the 22% marginal federal tax bracket, along with Colorado’s flat tax of 4.25% (now 4.4%), is losing an additional $1,391.25 in tax savings ($115.94/month). This means that their effective increase is 39.5%.

In dollar terms the plan design change along with the premium increase is costing a member $243/month or $2,916 for the year. And, for two-PERA retiree families (like mine) that adds up to an increase of $5,832.

I want to be clear. This is a complicated issue, there are no easy answers, and PERA has many competing priorities when deciding on plan design. They have to make tough decisions in order to try to come up with the best plan design for all PERA members. I get that. But I also think it’s worth pointing out the magnitude of the financial impact this will have on PERA members who were on this plan.

PERA currently has a 1% annual increase in member’s pension benefit (after a three-year delay) to help offset the impact of inflation. That 1% increase is not even coming close to offsetting inflation, but it’s really not keeping up with a $5,832 increase due to a PERACare plan design change. It’s also important to keep in mind that this increase will recur each and every year until we hit Medicare. I would encourage PERA to consider offering Kaiser’s HSA-qualified HDHP again in the future (as well as educating members on the benefits of an HSA). I also think the Colorado Legislature (not to mention the United States as a whole) is going to need to seriously look at what they can do to make health insurance affordable again for public service retirees. If they don’t, more people will start taking the risk of being uninsured (at least until they hit Medicare age), and that will end up not only impacting their health but will cost all of us more.

One thought on “PERACare Premium Increases and the Impact of a Plan Design Change”