I’ve written previously comparing our options for health insurance in retirement (2024, 2025). In both years insurance through the ACA Marketplace was easily the better choice. But for 2026 there are big changes to both PERACare and the ACA Marketplace that are going to make the comparison much closer (and more complicated).

The big change for PERACare is a plan design change for the plan we would choose. They are no longer offering an HSA-qualified High Deducible Health Plan choice through Kaiser. As a result, not only is the premium increasing significantly but we lose the HSA option (and associated tax savings).

On the ACA Marketplace side, of course, the big (huge) change is the change to the available subsidies. Unless Congress acts (this is the major sticking point around the current government shutdown), the enhanced ACA subsidies will expire at the end of 2025. The subsidies will revert back to what they previously were.

As can you see from the chart, the previous subsidies (middle column) were significantly lower for everyone and, crucially for us, are eliminated completely for modified adjusted gross income (MAGI) greater than 400% of federal poverty level (FPL). Under the current enhanced subsidies, premiums for those making over 400% of FPL were capped at 8.5% of your MAGI. (Note that if your income is really high this ends up as no subsidy, because the unsubsidized premiums are lower than 8.5% of a very high income.) In addition, the unsubsidized premiums themselves increased dramatically this year not only due to increases in health care costs, but because insurance companies know that with the expiration of the enhanced subsidies many people – particularly healthier people – will leave the marketplace (making it more expensive for those who remain). For my wife and I our ACA marketplace premiums are increasing by $12,492 per year (a 125% increase from last year). We will be paying over $22,000 next year in health insurance premiums via the marketplace.

Note that we also have dental and vision coverage through PERACare at about $110/month, so another $1,320 a year for those.

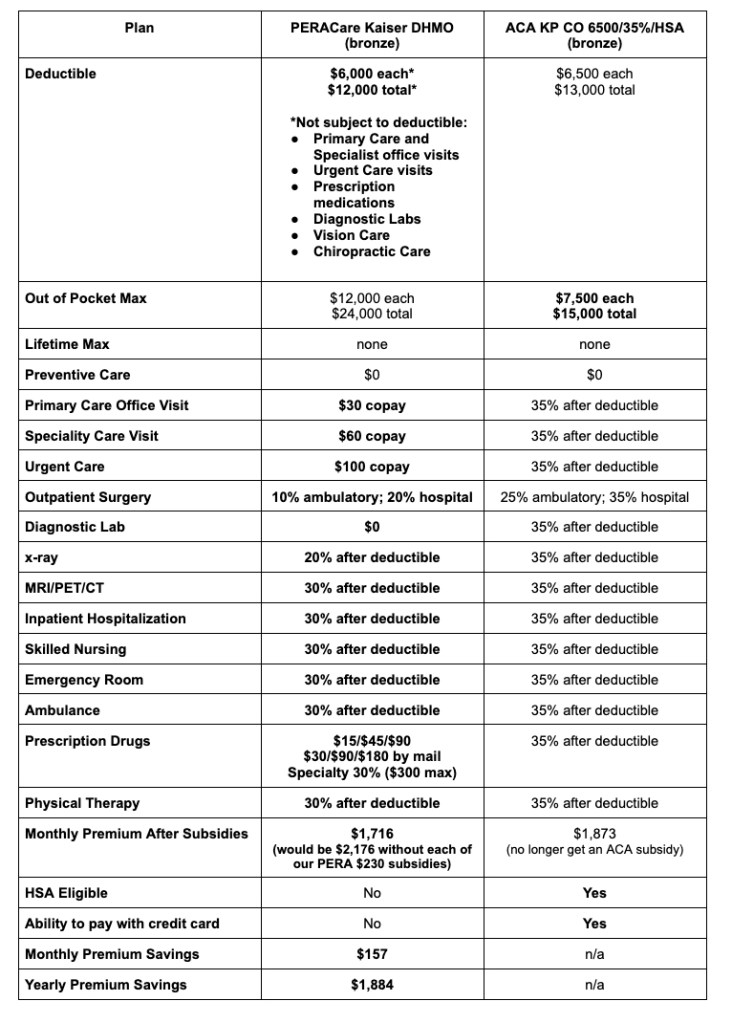

So here’s a comparison for 2026 of the new Kaiser Deductible HMO plan through PERACare and the current Kaiser HDHP Bronze Plan we have through the ACA Marketplace. The bolded items indicate the better plan on each metric.

At first glance, it appears as though the PERACare option is the clear winner (although still not inexpensive). It has both a lower premium and potentially lower out-of-pocket costs for many services that are not subject to the deductible (although importantly the maximum out-of-pocket costs are higher than the marketplace plan).

But there are four additional considerations that don’t make that choice quite as clear cut.

- Possibility of the Enhanced ACA Subsidies Getting Extended: It is still possible that the enhanced ACA subsidies will be extended by Congress (just for next year or perhaps “permanently”.) It’s very difficult to predict whether this will happen, but this is not a winning issue for the GOP so there is definitely still a chance. This matters because if we choose the PERACare option (open enrollment for PERACare ends November 20th) and subsequently the enhanced subsidies are extended, we would not be able to switch for next year. With the enhanced subsidies, the cost for our plan through the ACA Marketplace would be around $1,100/month, so significantly less expensive than PERACare.

- Higher Out-of-Pocket Maximum: While it’s unlikely this would come into play, the main purpose of insurance is to protect against catastrophe (in this case, the catastrophe of a truly horrible (and expensive) health care year). Because the Marketplace plan has a much lower out-of-pocket maximum ($4,500 less for each of us, $9,000 for both of us), it would end up being less expensive in a truly horrible year.

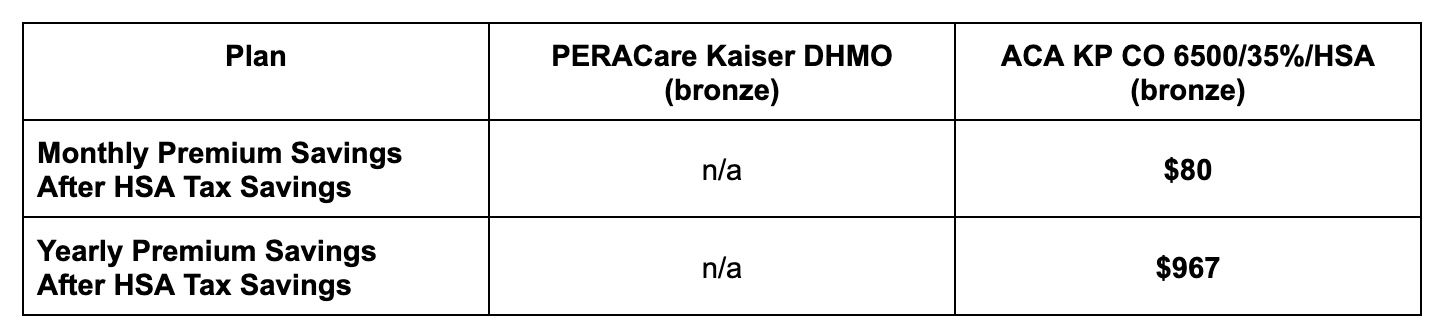

- The Health Savings Account (HSA) Factor: The PERACare plan is not HSA-qualified, the ACA Marketplace plan is. Because my wife and I are both over 55, we can each contribute up to $5,400 to our HSAs in 2026 ($10,800 total). Since we are in the 22% marginal federal tax bracket, and Colorado has a 4.4% flat tax, that saves us $2,851 in taxes (or $237/month). And since we are still investing our HSA instead of reimbursing ourselves, the $10,800 has the potential to grow to even more tax free. But ignoring the possible growth, the tax savings from the HSA contributions effectively makes the Marketplace plan less expensive (in terms of premiums) than the PERACare plan.

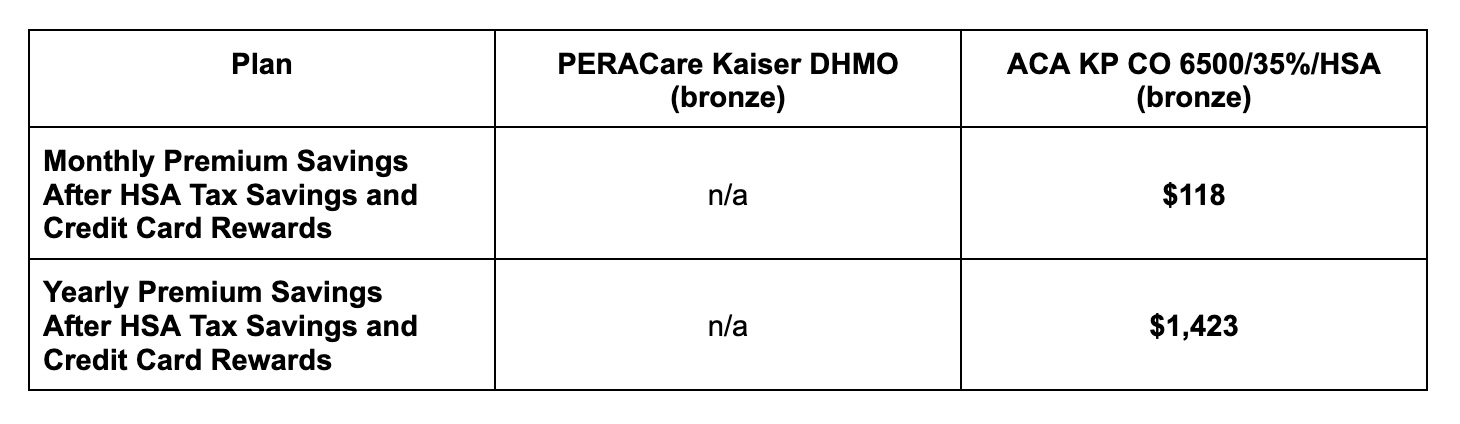

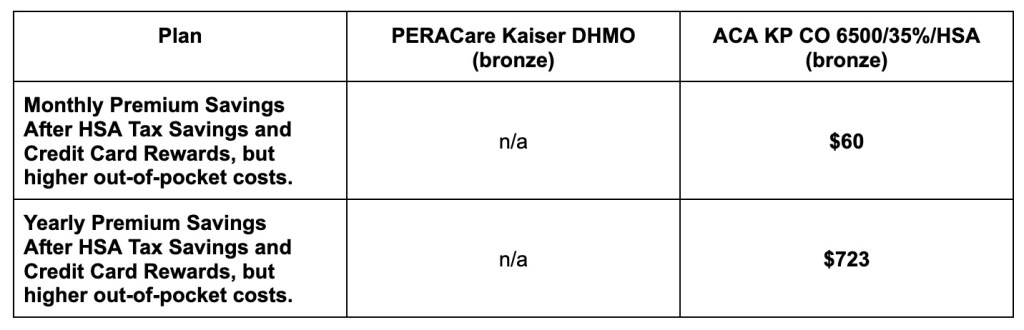

- The Credit Card Rewards Factor: If we choose PERACare the premiums automatically get deducted from our pension checks. While this is convenient it also means that we can’t use a credit card to pay them. With the marketplace plan we can use a credit card (with no surcharge). This means at a minimum we will get 2% cash back on our premiums (and possibly more if we use the premiums with new credit cards to get signup bonuses). Here’s a comparison of the two plans when you factor in both the tax savings from the HSA and the 2% cash back from paying with a credit card.

As you can see, this makes the Marketplace plan less expensive still (and conceivably a lot less expensive if we can leverage our premium payments for credit card signup bonuses).

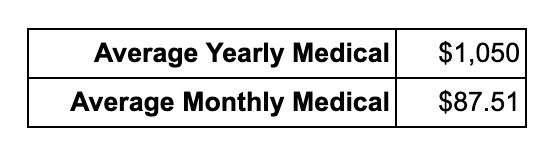

But this is still not a fair comparison because the PERACare plan should have somewhat lower out-of-pocket costs due to certain items not being subject to the deductible (primary care, specialist, urgent care, diagnostic lab, vision care, chiropractic care), and the coinsurance being a lower percentage once the deductible is met. So I looked at our out-of-pocket expenses for the last two years and averaged them. (This does not including prescriptions since those would’ve been the same under both plans because our prescriptions are very inexpensive.)

It’s important to understand that this is not the ultimate difference, as we would still have had some out-of-pocket costs under the PERACare plan, they just would’ve been somewhat lower (due to the copays). My estimate is that instead of $1,050 it would’ve been more like $350, so a net $700 savings ($58/month). So here’s the comparison with that additional $58/month estimate of increased out-of-pocket costs factored in.

So how do we choose given that we don’t know what our health needs will be next year? There are three main scenarios to consider.

- Good (normal) health care year: The Marketplace Plan is the better choice as it will be on the order of $708 cheaper.

- A bad health care year: The PERACare plan would likely(?) be better due to the copays for some services and the lower coinsurance amounts after the (slightly lower) deductible.

(Note that it depends on exactly what services we need; there are many scenarios where the Marketplace plan would still come out ahead due to the “head start” of the HSA tax and credit card reward savings.) - A really bad (catastrophic) year: The Marketplace plan would be better due to the lower out-of-pocket maximum (as well as the HSA tax and credit card rewards savings).

So which are we going to choose? We are going to go with the ACA Marketplace plan as it is going to end up being the less expensive option in most (but not all) scenarios, and could be significantly less expensive if the enhanced subsidies are extended by Congress. It is important to acknowledge that PERACare is still a good choice (and we’re glad to have the option).

Unfortunately with either option we are going to be paying over $1,000 a month more than we are this year, and over $22,000 for health insurance premiums for the year. We are fortunate that we can handle this (we would prefer not to, of course), but there are millions of families who cannot, so I hope that Congress does come through with some relief (and a better long-term solution to healthcare in this country).

As a nice side benefit, since we will not be utilizing PERACare and our small ($460/month between the two of us) subsidies, it will have a (very, very, very) small positive benefit for PERA. In reality it’s immaterial to a pension fund with over $60 billion in assets, but it still feels good.

One thought on “PERACare vs. ACA Marketplace: 2026 Edition”