Important: This post is for informational purposes and is not (necessarily) investment advice. All investments have risk, and this one is not a public market investment so could have even more risk. There is a possibility of losing your principal.

The vast majority of our portfolio is in index funds or similar broadly diversified, low cost investments. This is because the evidence clearly shows that this is the best way to invest and achieve your long-term investing goals. And that is what I recommend you do with your portfolio. Having said that, I occasionally invest a small amount of our portfolio in other types of investments when I have a particular purpose in mind. That purpose has usually been to support companies and/or projects that are working on/investing in sustainable energy or other areas that address climate change (while hopefully also earning some kind of return on investment).

Back in the 2010s we invested some money with Wunder Capital (now Wunder Power), which was providing financing for medium-sized businesses to install solar. They were so successful, however, that they attracted institutional investors and stopped accepting money from individual investors. We also invested some in Tesla stock in order to support their mission at a time when their prospects were touch-and-go as a company. That investment obviously did very well, although I have very mixed feelings about it due to the CEO’s subsequent political activities. But in the past few years I’ve been unable to find any investments that I was comfortable with. Most of the action in sustainable investing is happening in private start-up companies that are using venture capital funds, not money from individual investors. We’ve certainly loaned some money through Kiva, some of which has been in support of sustainable energy, but that’s not investing as we don’t get any return on our investment (and defaults slowly whittle away the principal).

So I was pretty excited when I recently discovered Energea*.

*Note that this is a referral link. If you follow that link and invest at least $100, you will receive a $100 bonus (and we will as well). If that bothers you, you can always choose to invest without the referral link, but of course you won’t get the bonus.

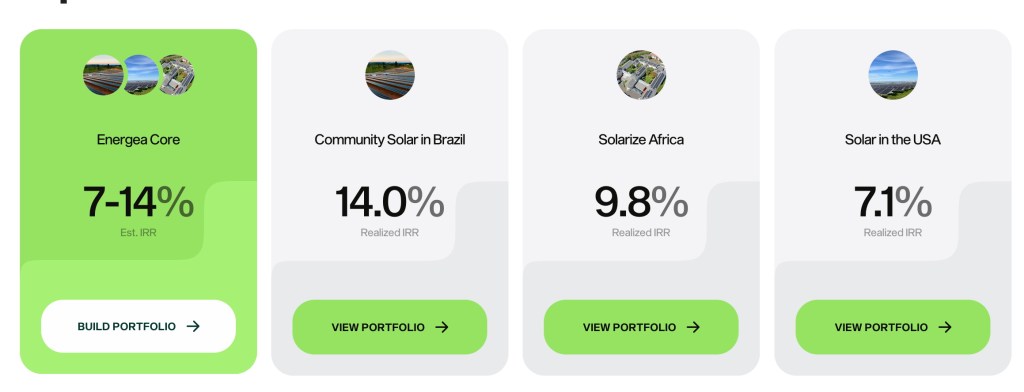

Energea owns a portfolio of renewable energy projects (mostly solar at this point, but at least one hydro project that’s for accredited investors only). They either build new projects or purchase and maintain/expand existing projects, and currently have energy project portfolios in the United States, Africa, and Brazil. (They are just ramping up projects in Latin America and that portfolio will likely become available in 2026.)

If you invest you are actually buying equity shares in one or more of their portfolios. The portfolios generate monthly dividends and the price of your shares can also appreciate (or depreciate) based on anticipated future cash flows. The cash flow comes from electricity sales from the projects, and is primarily from power purchase agreements and/or community solar customers.

While I was initially attracted to this because it was a way to invest in sustainable energy, it also provides some additional (potential) benefits from an investment standpoint.

- Diversification: This is investing in real assets and – theoretically at least – should not be correlated with the stock market.

- Inflation Protection: Because the price of electricity – and their contracts – are typically indexed to inflation, returns should keep up with inflation.

- Protection from Economic Downturns: Demand for electricity is growing, so even in an economic downturn there should be some protection for these projects. (Of course in a severe enough global economic downturn, this may not always be true.)

- High-Yield Returns: While there are no guarantees of course, they have a track record of providing high single-digit or low double-digit returns (varies a bit by the portfolio).

- Cash Flow: While we don’t particularly need this, the monthly dividends provide a regular cash flow.

- Low Minimum Investment: You can get started with as little as $100.

- Traditional and Roth IRA Options: You can invest through either a traditional or Roth IRA, which is attractive for tax reasons due to those monthly dividends. The IRA custodian charges a $150 annual fee. This is very high if you have a small investment (for example, on $10,000 that would be 1.5%), but very low for a large investment (for example, on $100,000 that would be a much more reasonable 0.15%).

But it’s important to keep in mind that all of these positive aspects also come with significant risk.

- This is a private investment vehicle, so does not have the transparency of investing in public markets.

- There are also significant risks investing in real asset infrastructure. I think they do a nice job of identifying the risks for each portfolio (see screenshot below for the risks they list for the Brazil portfolio), but I still don’t have a particularly good understanding of the magnitude and likelihood of the risks.

- While they have a roughly five-year track record of returns, they are still a very new company and therefore have all the risks associated with that.

- The investment is illiquid. While you can choose to withdraw your dividends as you receive them (or reinvest them), you can’t sell your shares at full value for three years from your initial purchase date. (They do allow you to sell before that if you really need to, but at a 5% discount to the current share price.)

- They are high fee (2% plus carried interest), although it is important to note that the returns they are targeting (and have achieved so far) are after fee returns.

- If you invest in a taxable account, you will be paying income taxes on your monthly dividends (although they are qualified dividends, so are taxed at the more favorable long-term capital gains tax rates). If and when you sell shares, they will be subject to capital gains taxes.

As you probably suspect since I’m writing this post, we have invested a small amount with Energea*. We’ll use the next year or so to learn more about it as well as see the actual returns. If after a year or so we are feeling comfortable with it, we may increase our investment amount. For us this feels pretty low risk because we are not investing very much of our portfolio and because we are okay if we get lower returns as long as it is supporting sustainable energy development. While we wouldn’t be happy if we lost some or all of our principal, that risk seems to be partially mitigated by the monthly dividends; we will have received some, all, or more than all of our principal back already. It’s also mitigated by the ownership (equity) of the real assets, although there is obviously no guarantees there (foreign country risk, risk of Energea going out of business, etc.)

This investment is definitely not for everyone. If you do decide to invest, I would recommend starting small (like we are) and see how it goes. And while you definitely don’t have to, you might as well use the referral link to get that $100 bonus*. If you do decide to invest, please let me know as I’m always curious what resonates with folks and what doesn’t.

One thought on “Investing in Solar Through Energea”