I just released Episode 12 of the Teaching You To Fisch podcast. This episode looks at three important investing decisions you need to make: Asset Location, Allocation and Tax Status. Slides Transcript It's available on Spotify, Apple Podcasts, and YouTube, and I've also embedded it below. As always, feedback is appreciated. https://youtu.be/MVS-7LNiiY8?si=b7F_-bjgi6iddf4t All episodes available … Continue reading Podcast Episode 12: Investing Part 2: Asset Location, Allocation, and Tax Status

Category: Asset Allocation

Not Just March Madness

Given the time of year (and the recent market volatility) I thought I'd make a quick post reminding folks that the key to investment success is investing in low-cost, diversified index funds selected based on your investment time horizon. As I've written previously, no one can consistently beat the market and there really is no … Continue reading Not Just March Madness

Appeared on the Teach and Retire Rich Podcast

Dan and Scott had me back on the Teach and Retire Rich podcast for those who might be interested. Apple Podcasts Direct link to the podcast on their site 403bwise 403bwise state 457 ratings Items mentioned in the podcast. Time to Buy! Buy! Buy! (Service Credit, 2025 Edition) (purchasing service credit) Our Current Portfolio and … Continue reading Appeared on the Teach and Retire Rich Podcast

Our Current Portfolio and Recent Returns

Each year I'm sharing what our current portfolio looks like. This is what it looks like as of January 1, 2025. (Here is April 2022 and January 2024). Asset Location Like many people, by necessity we have our investments in multiple places due to past employers, HSAs, and different types of taxable accounts. Taxable Investments: … Continue reading Our Current Portfolio and Recent Returns

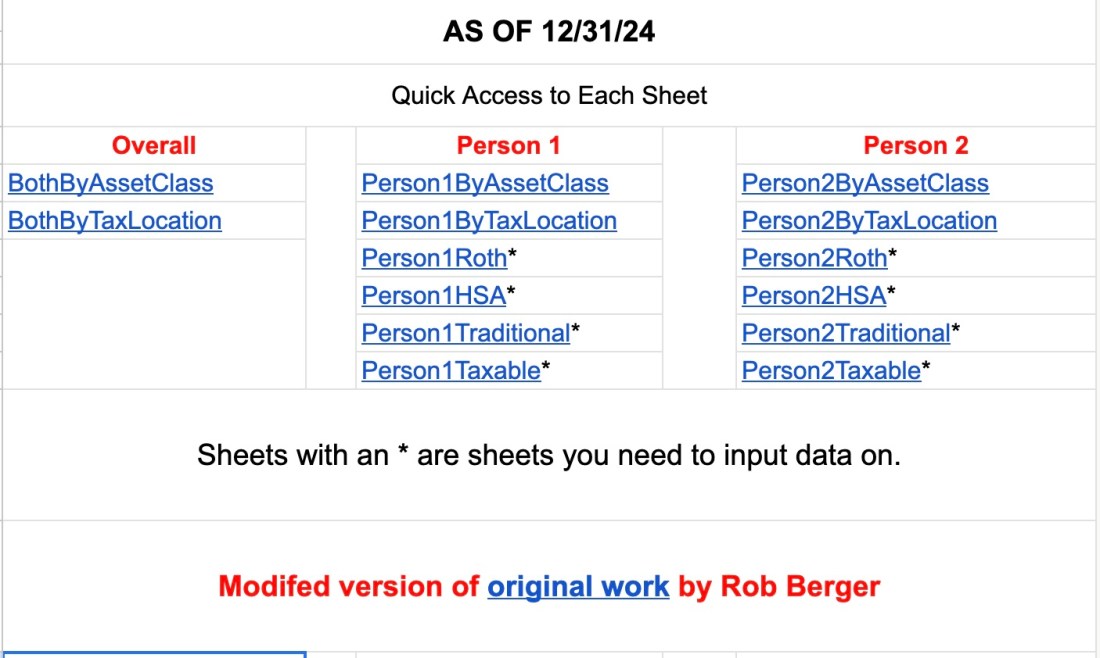

Asset Allocation and Rebalancing Spreadsheet

One of the most important aspects of investing is setting your asset allocation. There are a variety of factors that go into your asset allocation including your goals, your investing time horizon, your risk tolerance, and the rest of your financial situation. Once you've set an asset allocation you need to pay attention to it … Continue reading Asset Allocation and Rebalancing Spreadsheet

New Teacher (Financial) Orientation

I've been doing some financial presentations for educators in various Colorado school districts. As part of the intro to my presentation I reference the fairly typical "90-minute New Employee Orientation" that school districts often provide for new teachers and that, while these are well-intentioned, they usually fall woefully short of what they could (and should) … Continue reading New Teacher (Financial) Orientation