A topic that sometimes comes up in my financial literacy class, as well as other financial discussions, is people who will drive across town to a gas station with cheaper gas prices. I want to be clear, if you have multiple gas stations on your regular route and one has lower prices, then you should … Continue reading The “Driving to a Cheaper Gas Station” Problem

Category: expenses

Inflation (again)

I've written about inflation several times previously (here, here, here, and here), but it's a topic I keep returning to because I feel like it's a concept that many people still don't really understand. And, unfortunately, that often means they reach invalid conclusions, which can lead to poor financial decisions and/or lead people to just … Continue reading Inflation (again)

We Should Stop Using the Term “Emergency Savings”

I've written previously how I think some financial terms we use - for example, "unexpected expenses" - perhaps do more harm than good. In that same vein, I'd like to suggest that we stop using the term "emergency savings." Instead, we should just use the term "savings." Some folks will see this as semantics, and … Continue reading We Should Stop Using the Term “Emergency Savings”

Financial Literacy In One Sentence

When I talk with people about financial topics, either in my class or in person, they often say something along the lines of, “But it’s so complicated!” I agree that some topics can get pretty complicated, and certainly there are many things you can learn to help you optimize your finances. But I also gently … Continue reading Financial Literacy In One Sentence

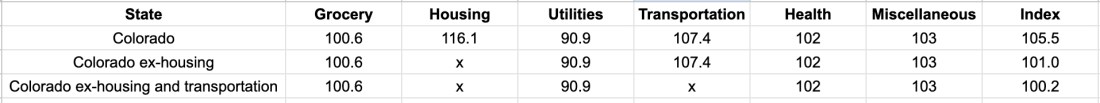

Is Colorado’s Cost of Living Really “So High”?

As with most of my blog posts, this is speaking to folks with a decent income (say at or around the median household income or better), frequently with a fair amount of additional privilege. That’s generally who is taking my class or reading this blog. In the financial literacy for Colorado teachers class I teach … Continue reading Is Colorado’s Cost of Living Really “So High”?

Most Unexpected Expenses…Aren’t

“Unexpected Expenses” is a topic that frequently comes up in my classes and when talking with others about finances. This is in the context of a discussion around spending less than you make, saving and investing the rest, and letting compound interest work its magic. Pretty much invariably, several folks will say something similar to … Continue reading Most Unexpected Expenses…Aren’t