I live in Colorado. A frequent financial topic that comes up in discussions with other folks and in my class is the cost of housing. It is certainly true that housing in Colorado is above the median for the U.S., but as I mentioned in that post I think many Coloradan's have a skewed view … Continue reading Colorado House Prices and Rent (Don’t) Always Go Up

Category: investing

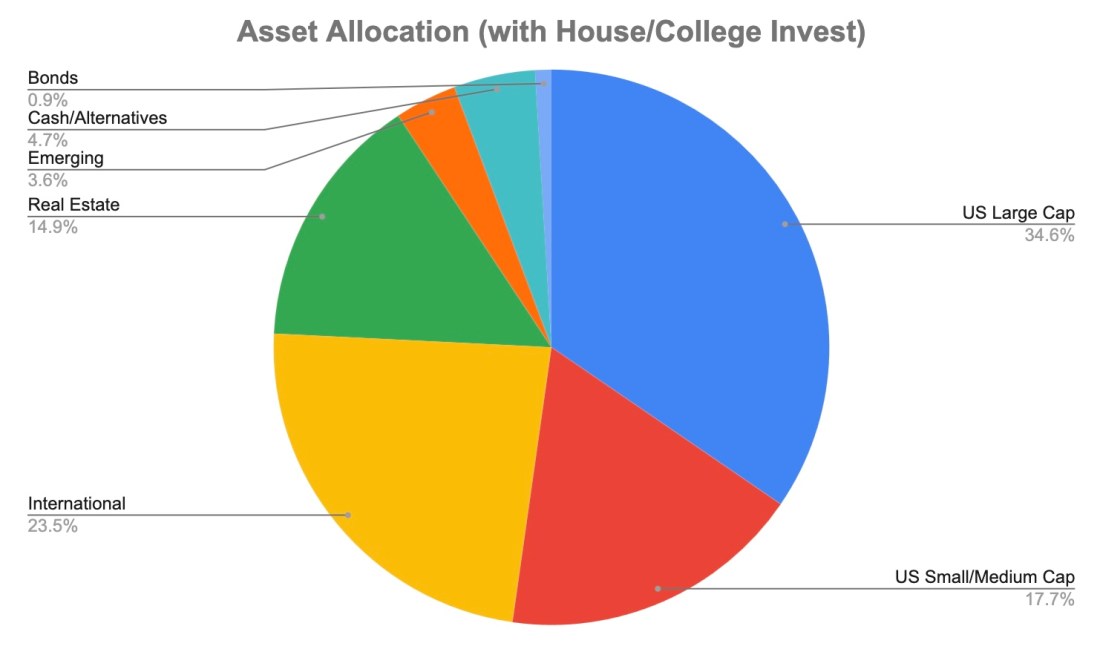

Our Current Portfolio and Recent Returns as of January 2026

Each year I'm sharing what our current portfolio looks like. This is what it looks like as of January 1, 2026. (Here is April 2022, January 2024, January 2025). Asset Location Like many people, by necessity we have our investments in multiple places due to past employers, HSAs, and different types of taxable accounts. Taxable … Continue reading Our Current Portfolio and Recent Returns as of January 2026

Investing in Solar Through Energea

Important: This post is for informational purposes and is not (necessarily) investment advice. All investments have risk, and this one is not a public market investment so could have even more risk. There is a possibility of losing your principal. The vast majority of our portfolio is in index funds or similar broadly diversified, low … Continue reading Investing in Solar Through Energea

Car-less in Colorado

To be perfectly clear, this post is not about my family. We have two cars (EVs) for the three drivers in our family. And we currently have no plans to get rid of those cars. Rather, this post is about the possibilities for folks who live in my area to conceivably go without a car … Continue reading Car-less in Colorado

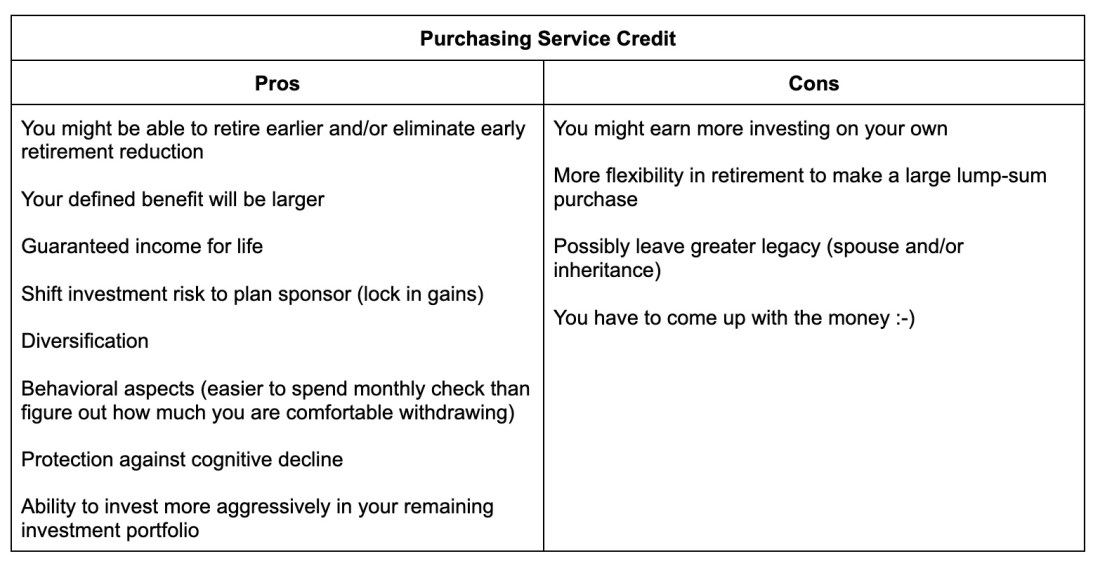

Diversifying by Purchasing Service Credit

I've written previously that people with defined benefit pensions who have the option to purchase service credit should seriously consider doing so now. I first wrote about it back in December of 2021, added some more context in April of 2022, and then reiterated in January of this year. Well, stop me if you've heard … Continue reading Diversifying by Purchasing Service Credit

PERACare vs. ACA Marketplace: 2026 Edition

I've written previously comparing our options for health insurance in retirement (2024, 2025). In both years insurance through the ACA Marketplace was easily the better choice. But for 2026 there are big changes to both PERACare and the ACA Marketplace that are going to make the comparison much closer (and more complicated). The big change … Continue reading PERACare vs. ACA Marketplace: 2026 Edition