Just a little over 3 years ago I wrote a post encouraging folks to purchase service credit in their pension system if they were eligible and could afford to do it. While the entire post is worth reading for the full context, I wanted to pull out this quote, The second reason I think purchasing … Continue reading Time to Buy! Buy! Buy! (Service Credit, 2025 Edition)

Category: investing

Our Current Portfolio and Recent Returns

Each year I'm sharing what our current portfolio looks like. This is what it looks like as of January 1, 2025. (Here is April 2022 and January 2024). Asset Location Like many people, by necessity we have our investments in multiple places due to past employers, HSAs, and different types of taxable accounts. Taxable Investments: … Continue reading Our Current Portfolio and Recent Returns

Should I Invest in My Traditional, Roth, or Taxable Account?

IT DEPENDS! Okay, I really wanted to just leave this as a two-word blog post, but I decided that probably wasn't all that helpful. The genesis of this post was a discussion on Facebook where people were giving advice about what account someone should invest money in. Often these folks are really big fans of … Continue reading Should I Invest in My Traditional, Roth, or Taxable Account?

Asset Allocation and Rebalancing Spreadsheet

One of the most important aspects of investing is setting your asset allocation. There are a variety of factors that go into your asset allocation including your goals, your investing time horizon, your risk tolerance, and the rest of your financial situation. Once you've set an asset allocation you need to pay attention to it … Continue reading Asset Allocation and Rebalancing Spreadsheet

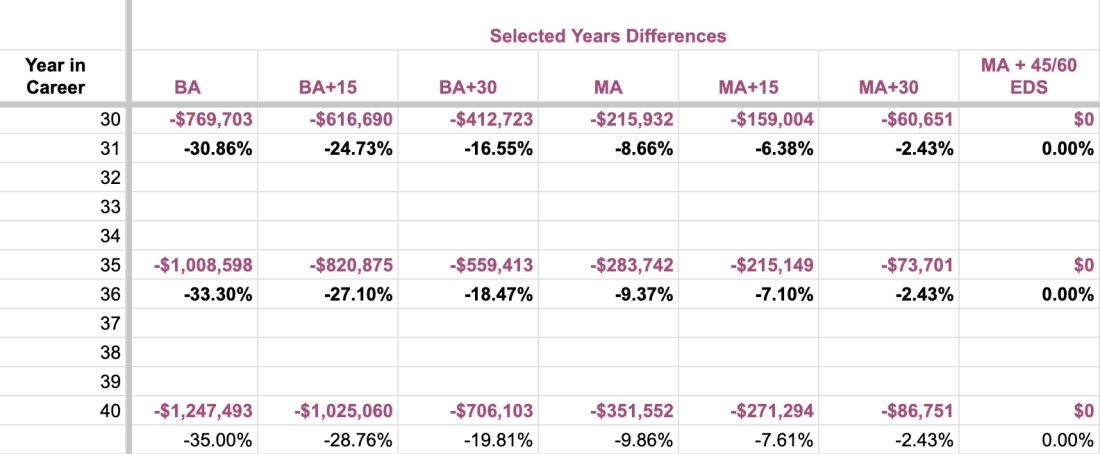

Salary Schedule Lanes: Your Million Dollar (or two or three) Decision

Many school districts have a salary schedule for teachers where your pay increases based on a combination of the number of years you have taught in the district ("steps") and the educational level you attain ("lanes"). While steps are automatic (well, except for the occasional bad budget year where steps are frozen), lanes are dependent … Continue reading Salary Schedule Lanes: Your Million Dollar (or two or three) Decision

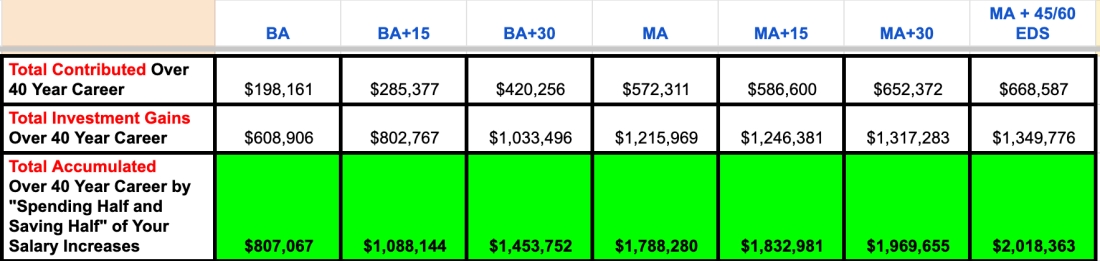

Invest Half Your Raises

In the financial literacy class I teach for educators we frequently talk about the concept of "paying yourself first." Think of "yourself" (or your future self, if you prefer) as an expense that you have to budget for and, just like you set aside money for the mortgage and the electric bill, set aside money … Continue reading Invest Half Your Raises