Important: This post is for informational purposes and is not (necessarily) investment advice. All investments have risk, and this one is not a public market investment so could have even more risk. There is a possibility of losing your principal. The vast majority of our portfolio is in index funds or similar broadly diversified, low … Continue reading Investing in Solar Through Energea

Tag: Asset Allocation

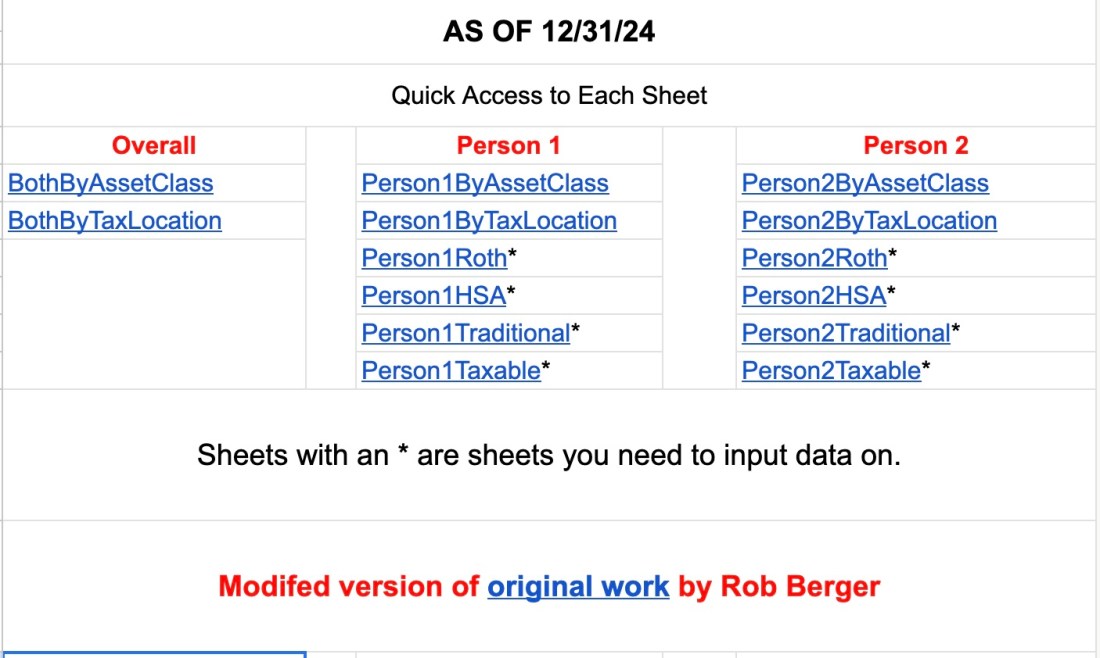

Spreadsheet: Asset Allocation, Compound Interest, and Fees

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Asset Allocation, Compound Interest, and Fees

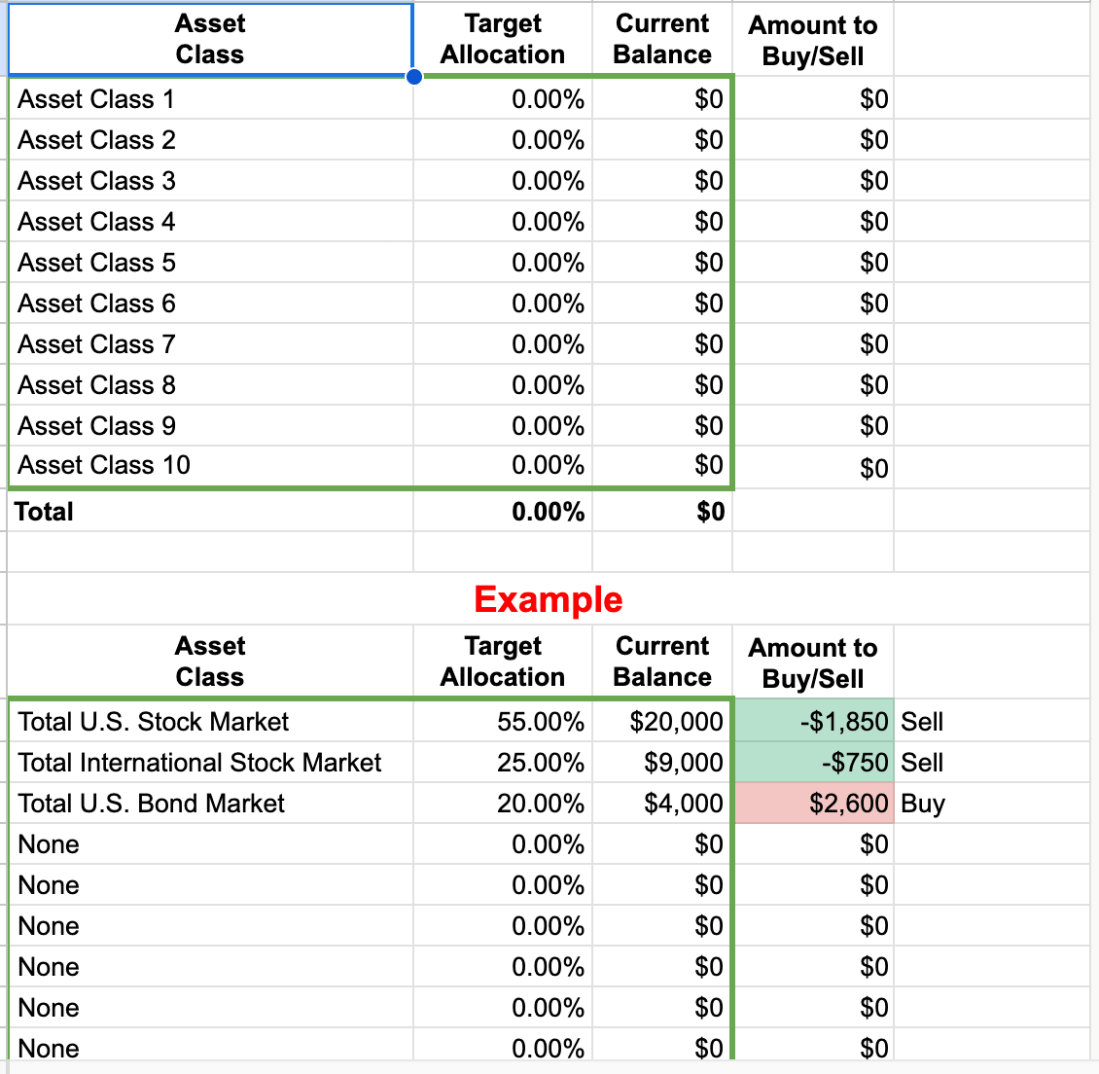

Spreadsheet: Simple Rebalancing

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Simple Rebalancing

Podcast Episode 12: Investing Part 2: Asset Location, Allocation, and Tax Status

I just released Episode 12 of the Teaching You To Fisch podcast. This episode looks at three important investing decisions you need to make: Asset Location, Allocation and Tax Status. Slides Transcript It's available on Spotify, Apple Podcasts, and YouTube, and I've also embedded it below. As always, feedback is appreciated. https://youtu.be/MVS-7LNiiY8?si=b7F_-bjgi6iddf4t All episodes available … Continue reading Podcast Episode 12: Investing Part 2: Asset Location, Allocation, and Tax Status

Not Just March Madness

Given the time of year (and the recent market volatility) I thought I'd make a quick post reminding folks that the key to investment success is investing in low-cost, diversified index funds selected based on your investment time horizon. As I've written previously, no one can consistently beat the market and there really is no … Continue reading Not Just March Madness

Asset Allocation and Rebalancing Spreadsheet

One of the most important aspects of investing is setting your asset allocation. There are a variety of factors that go into your asset allocation including your goals, your investing time horizon, your risk tolerance, and the rest of your financial situation. Once you've set an asset allocation you need to pay attention to it … Continue reading Asset Allocation and Rebalancing Spreadsheet