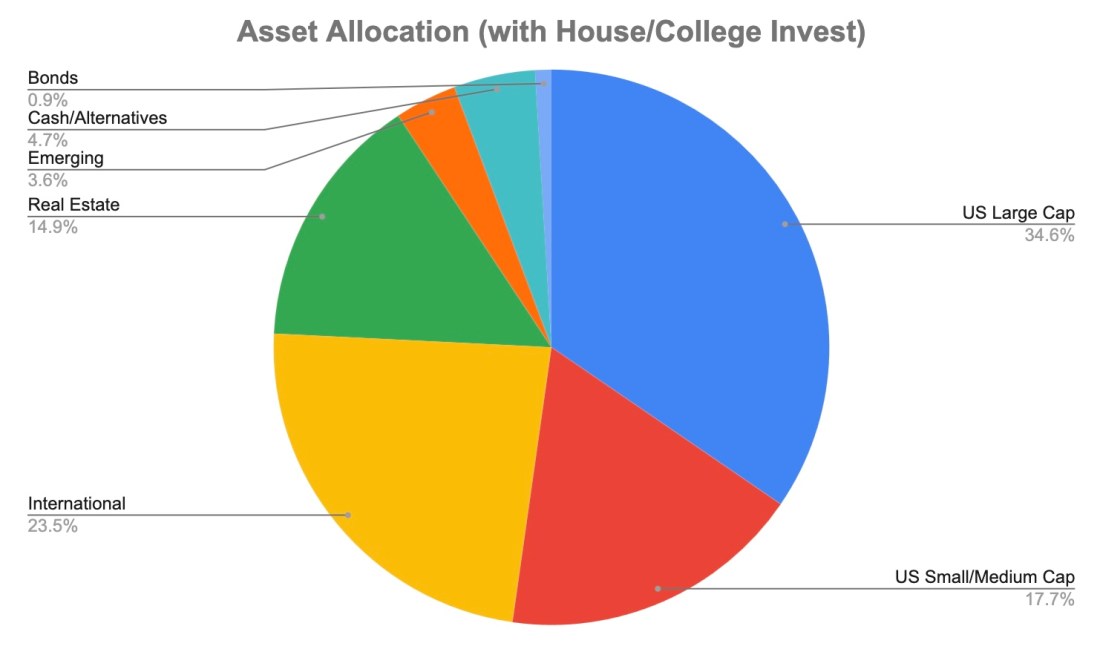

Each year I'm sharing what our current portfolio looks like. This is what it looks like as of January 1, 2026. (Here is April 2022, January 2024, January 2025). Asset Location Like many people, by necessity we have our investments in multiple places due to past employers, HSAs, and different types of taxable accounts. Taxable … Continue reading Our Current Portfolio and Recent Returns as of January 2026

Tag: taxes

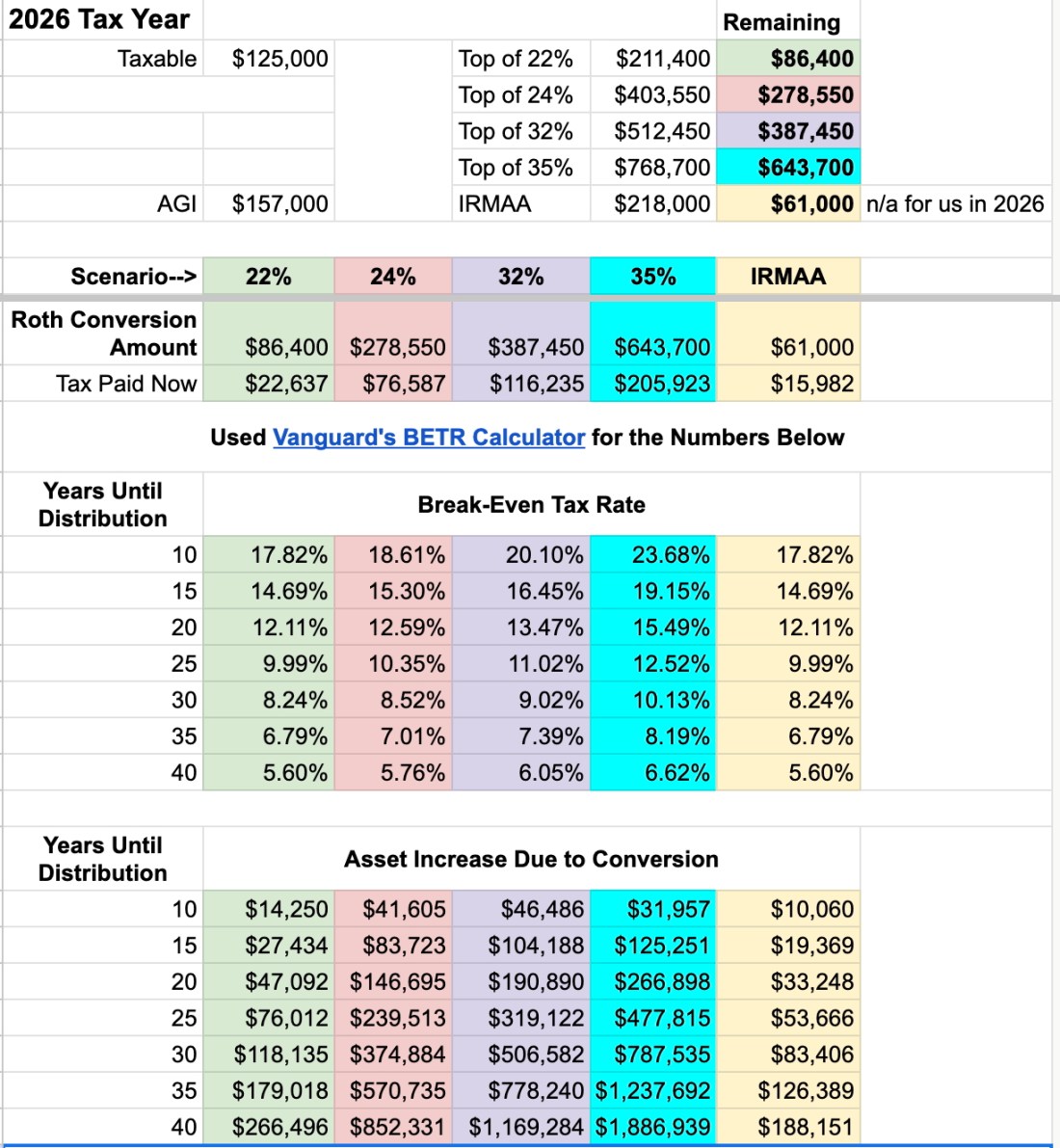

Our BETR Roth Conversion Decision Spreadsheet

Roth Conversions are a topic that comes up occasionally so I thought I'd talk a bit about how we currently think about this. For those who aren't familiar, a Roth Conversion is when you take some of (or all) the money that is currently sitting in a pre-tax IRA/401k/403b/457b and move it to a Roth … Continue reading Our BETR Roth Conversion Decision Spreadsheet

2026: New Year, New Limits

As we are about to turn the page (click the arrow?) on the calendar to move into 2026, there are many changes that happen around taxes. These include tax bracket changes, changes in the limits of what you can contribute to various retirement accounts, and a variety of other changes. The following is by no … Continue reading 2026: New Year, New Limits

Colorado’s E-Bike Tax Credit Decreases January 1, 2026

I've written previously about Colorado's excellent e-bike tax credit. Each Coloradan currently qualifies for a $450 tax credit (applied at the time of purchase) for eligible e-bikes. There are some minor restrictions: the bike has to be UL-certified, you must purchase from a registered Colorado e-bike retailer (which I understand, but is a bit of … Continue reading Colorado’s E-Bike Tax Credit Decreases January 1, 2026

Roth Conversions and Filling Up Tax Brackets

The topic of Roth conversions and filling up your tax bracket came up at this month's meeting of the Southern Colorado Mustachian group. While I've previously written about the related topic of capital gains harvesting, this is a bit different and has some interesting nuances. What is a Roth Conversion? A Roth conversion is when … Continue reading Roth Conversions and Filling Up Tax Brackets

Podcast Episode 12: Investing Part 2: Asset Location, Allocation, and Tax Status

I just released Episode 12 of the Teaching You To Fisch podcast. This episode looks at three important investing decisions you need to make: Asset Location, Allocation and Tax Status. Slides Transcript It's available on Spotify, Apple Podcasts, and YouTube, and I've also embedded it below. As always, feedback is appreciated. https://youtu.be/MVS-7LNiiY8?si=b7F_-bjgi6iddf4t All episodes available … Continue reading Podcast Episode 12: Investing Part 2: Asset Location, Allocation, and Tax Status