I’ve written previously about health insurance in retirement for members of Colorado PERA. As we are now in open enrollment for 2024, I thought I would update with current numbers as well as with a philosophical question. But first, a little background.

PERACare is health insurance that PERA retirees can get through PERA. It is guaranteed issuance (which was very important before the Affordable Care Act, and still nice now) and is even partially subsidized as part of your retirement benefit. But it’s still pretty expensive. Now that the ACA has come long, getting coverage on the ACA marketplace is also on option for PERA retirees, but one that some folks don’t really know much about. The ACA marketplace is also subsidized but, in the past, it was only for lower-income folks (up to 400% of the poverty line). Above that, you paid full price. So for many with decent incomes in retirement (decent benefits from PERA) they had too high of an “income” to get the ACA subsidy, so PERACare was often the better deal.

But then along came the American Rescue Plan Act which substantially enhanced the subsidies for 2021 and 2022 due to the pandemic. Then along came the Inflation Reduction Act which extended those enhanced subsidies through 2025.

As a result, even folks with a good PERA pension still qualify for a subsidy that keeps their premiums no more than 8.5% of their income. For many, that makes getting insurance through the marketplace less expensive than through PERACare. (Note that for people with very high incomes that 8.5% of income ends up being more than their premium at some point, so there would be no subsidy.)

So let’s take a look at 2024 numbers to see if the ACA marketplace is still better than PERACare (at least for us as a representative PERA retiree; everything below is for covering two of us with no dependents). I’ll show two example below, one for the Kaiser HDHP offered by PERACare (and the marketplace), and one for United Healthcare (UMR). Just for reference, here are the breakdowns in the number of PERA pre-Medicare retirees who currently choose each option.

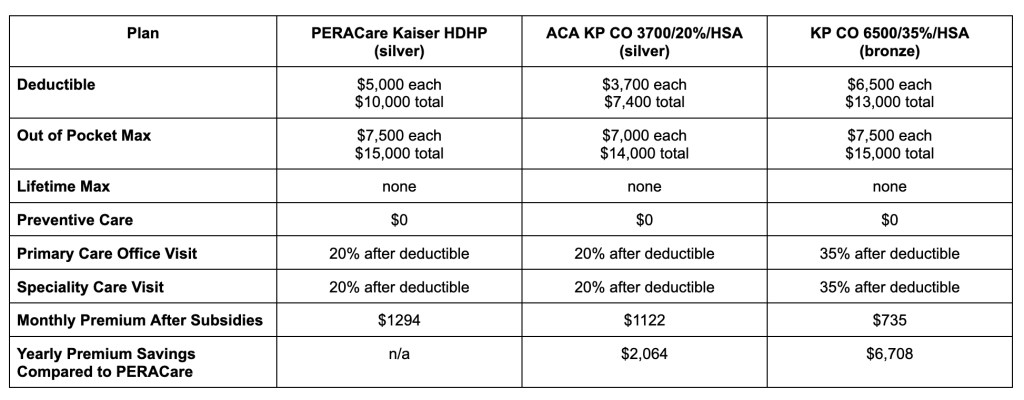

We prefer the Kaiser HDHP plan, both because we have been very happy with Kaiser and because we want to be able to contribute to an HSA. The plan offered under PERACare is a “silver” level plan and is very similar to one of the silver plans offered on the ACA marketplace (with the marketplace silver arguably being slightly better). I’ve also included a bronze plan as that’s the one we’ve chosen for ourselves.

It’s always tricky when comparing plans because the various provisions don’t always match up exactly. But, in general, I would suggest that the silver plan through the ACA marketplace is better than what’s offered through PERACare and would cost us $2,064 less per year. (The one exception might be if you have expensive specialty prescription drugs, as PERACare doesn’t have a “hole” in coverage for prescriptions.) We’ve chosen to go with the bronze package, which is slightly higher deductibles and coinsurance than the silver package (although total out of pocket is the same as PERACare silver), but saves us $6,708 in premiums per year.

A quick note about subsidies. Under PERACare, if you are pre-Medicare your subsidy can be up to $230 per month with 20 or more years of service. If you have less than 20 years, it’s prorated. For my wife and I, that means that the above premium for PERACare is after $460 in subsidies (as we both get the $230). For ACA subsidies, it depends on your income (see the table earlier in this post), and our income is likely higher than most PERA retirees because we both have very good PERA pensions plus I make a little bit teaching classes and from book sales. The average PERA retiree has less income than we do so their ACA subsidy would be even higher than what we are getting. In other words, the savings for the average PERA retiree is likely greater than what is shown in the table above (because the PERA subsidy is fixed but the ACA subsidy varies by income).

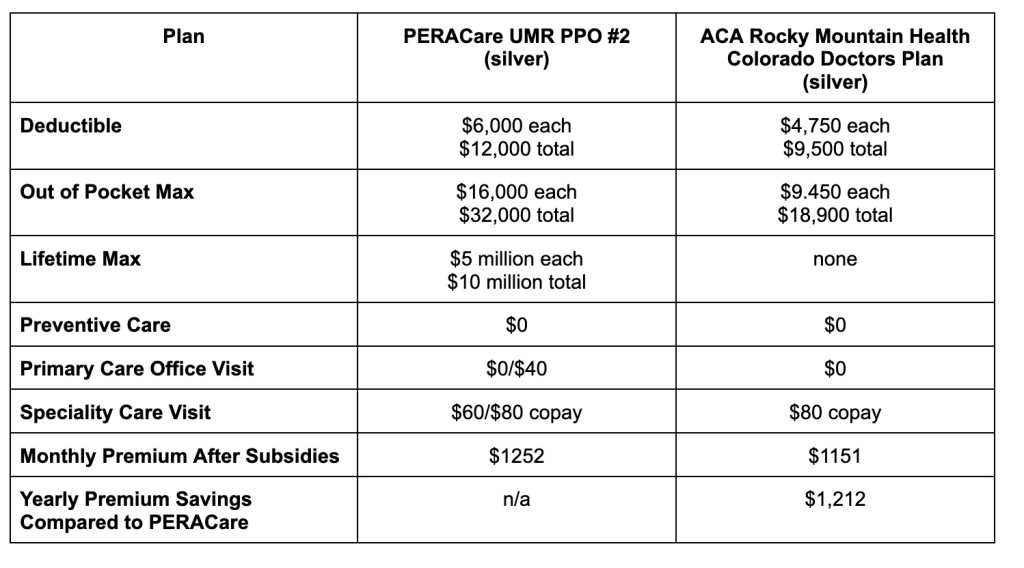

While we’ve chosen Kaiser HDHP, the UMR (United Healthcare) PPO #2 is the most popular pre-medicare plan for PERACare retirees (likely because it’s less expensive and is nationwide, whereas Kaiser is only available in limited locations). It’s a bit more difficult to find an ACA plan that matches exactly with the PPO #2, but here’s a comparison of one (also United Healthcare) that’s pretty close. (I didn’t do a bronze comparison for this one.)

Again, arguably, the ACA plan is better and costs $1,212 less per year (and, for the average PERA retiree, the savings would be even higher than $1,212 because their income is likely lower than ours).

So if you are a PERA retiree that hasn’t reached Medicare age (PERACare once you are on Medicare is a different calculation and likely a bit better than the marketplace) you should at least explore the marketplace as an alternative to PERACare. Many folks will be able to save anywhere from $1,000 to $10,000 a year in premiums for about the same level of coverage.

Now for the philosophical question. The PERA Board of Trustees as well as PERA Staff are fiduciaries for PERA members. This means, among other things, they have the Duty of Loyalty, which means they always have to act in the best interests of the members. Currently, PERA does a great job of providing information about PERACare to their retired members and they do mention the ACA marketplace as another option. But, as far as I know, they don’t specifically say that pre-Medicare retirees can likely get a much better deal on the marketplace (at least through 2025). So the philosophical question is if, under the Duty of Loyalty, PERA should be proactively giving members more specific information that the ACA marketplace is likely the better choice. After all, it would likely save members between $1,000 and $10,000 a year in premiums (and perhaps additional savings in out of pocket), which is certainly “in the best interests of the members.” In addition, for every pre-Medicare retiree who chooses the ACA marketplace over PERA, PERA doesn’t end up paying the up to $230 subsidy for them, which means it would help the Health Care Trust Fund reach full funding sooner (which would benefit all PERA members).

I honestly don’t know whether this would fall under their fiduciary responsibility or not, and I realize it would be tricky for them to implement because they aren’t in the position of helping members decide which policy would be “best” for them. But I do think there could perhaps be much more of an effort to inform folks that they can probably do better than PERACare before signing up for it because they just assume PERACare is the best option for them. I would guess (and it is just a guess) that at least half of the pre-Medicare folks on PERACare would be better off on the ACA marketplace (at least through 2025). If that 50% number is even close to being accurate, then some back of the envelope calculations show that would mean an estimated collective savings for PERA members of between $4-$15 million a year in premiums, with an additional $500,000 to $1 million in yearly subsidy savings to the PERA Health Care Trust Fund. Those are numbers that are worth discussing and I think it’s worth the effort for PERA to try to figure out how to thread the needle of giving their members this information in a reasonable – and actionable – way.

Postscript: Just to clarify, this is not PERA’s “fault” in any way. They cannot access the ACA subsidies.

3 thoughts on “PERACare vs. ACA Marketplace: 2024 Edition”