Last April I shared our portfolio and some of the different ways we look at it. I thought it might be nice to update it each January. That previous post has a bit more descriptive verbiage, so refer back to it if you need to.

Asset Location

Like many people, by necessity we have our investments in multiple places due to past employers, HSAs, and different types of taxable accounts.

- Taxable Investments: Vanguard

- Traditional and Roth IRAs: Vanguard

- Health Savings Accounts: Fidelity (Vanguard doesn’t offer HSAs)

- Traditional 401ks: Colorado PERA (our pension system which also offers a 401k and 457)

- Checking and Savings/Money Market: Ally Bank, Vanguard Money Market

- College Savings 529 Plan: CollegeInvest Direct Portfolio (see also this post)

Asset Allocation

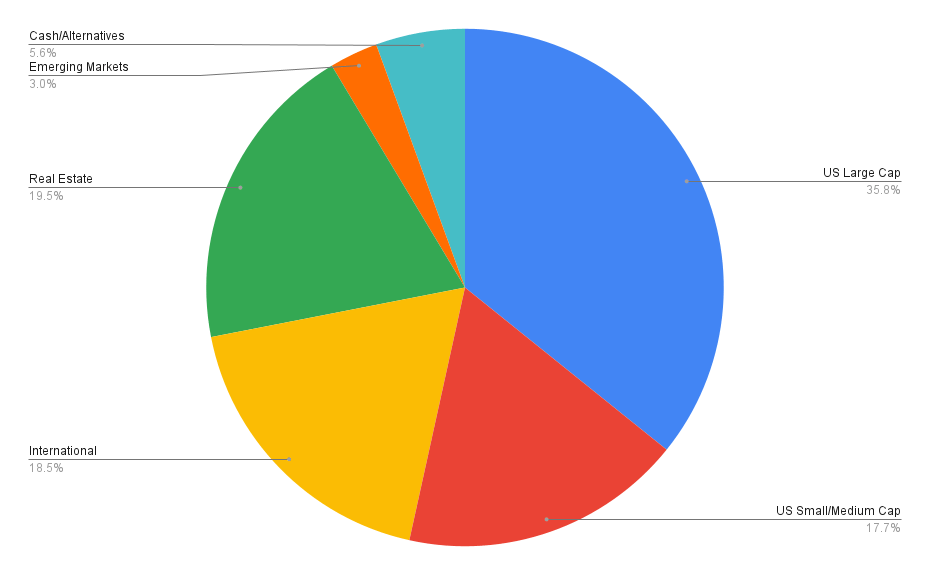

This is our current allocation to the different asset classes we are invested in (this breakdown does not include our college savings and the equity in our house, since college savings is a bit different purpose and our house is not liquid).

- US Large Cap Equities: 44%

- US Small/Medium Cap Equities: 22%

- International Equities: 22%

- Real Estate: 2% (not including house)

- Emerging Markets Equities: 4%

- Cash/Alternatives: 6%

If we did include our 529 college savings and the value of our house, it would look like this:

Asset Tax Status

- Currently Taxable: 19%

- Not Yet Taxed: 36%

- Already Taxed: 45%

Recent Returns

I thought it might be helpful to include recent (1 year and 10 year) returns for our three major asset classes. Again, this is more individual investment choices (funds) than we really need, but because of the different custodians due to asset location and legacy reasons, we have some funds that are very similar but not exactly the same.

Our current yield for cash (and cash-like) is 4.4% for our Ally Money Market and 5.32% (current 7-day yield) for our Vanguard Money Market.

I’m not sure how helpful this is (if at all), but one of the big issues in personal finance is that many people are reluctant to talk about their finances. So my hope is that by sharing this it will help others be more comfortable talking about their portfolios (as well as other financial decisions they have made).

2 thoughts on “Our Current Portfolio and Recent Returns”