Each year I’m sharing what our current portfolio looks like. This is what it looks like as of January 1, 2025. (Here is April 2022 and January 2024).

Asset Location

Like many people, by necessity we have our investments in multiple places due to past employers, HSAs, and different types of taxable accounts.

- Taxable Investments: Vanguard

- Traditional and Roth IRAs: Vanguard

- Health Savings Accounts: Fidelity (Vanguard doesn’t offer HSAs)

- Traditional 401ks: Colorado PERA (our pension system which also offers a 401k and 457)

- Checking and Savings/Money Market: Ally Bank, Vanguard Money Market

- College Savings 529 Plan: CollegeInvest Direct Portfolio (see also this post)

Asset Allocation

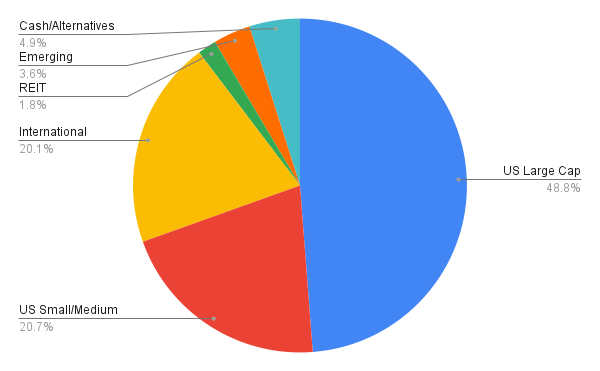

This is our current allocation to the different asset classes we are invested in (this breakdown does not include our college savings and the equity in our house, since college savings is a bit different purpose and our house is not liquid). Because of the continued out-performance of U.S. stocks, the split between U.S. and International continued to increase a bit from our target allocation. We’ve rebalanced a bit with new money, but because we are no longer working we do not have as much new money to invest (and, of course, the incredible performance of U.S. stocks has increased the denominator significantly). I will probably do a bit of rebalancing within our tax-advantaged accounts soon.

- US Large Cap Equities: 48.8%

- US Small/Medium Cap Equities: 20.7%

- International Equities: 20.1%

- Real Estate: 1.8% (not including house)

- Emerging Markets Equities: 3.6%

- Cash/Alternatives: 4.9%

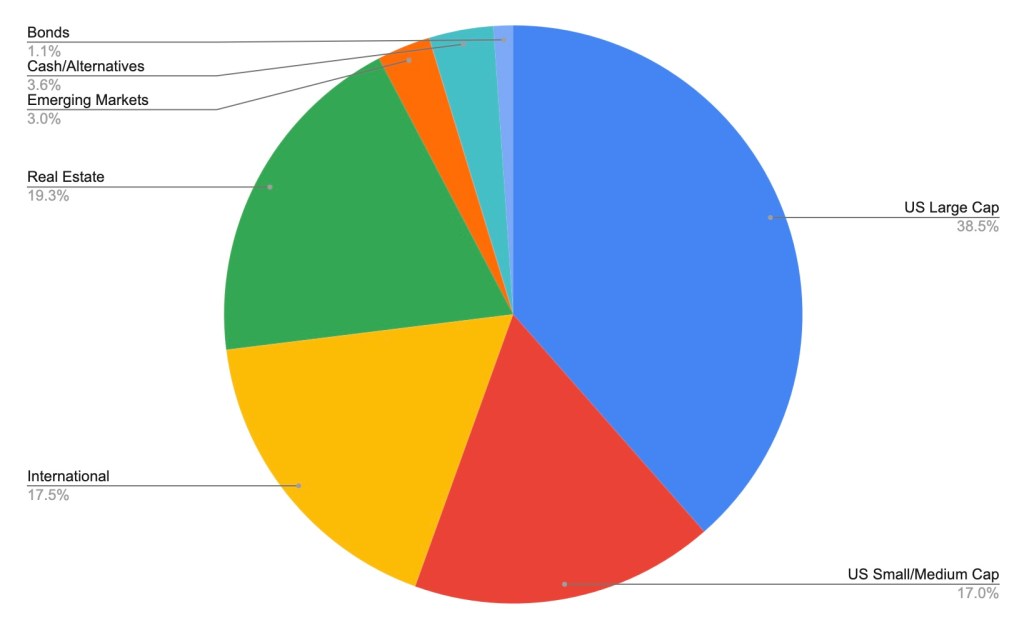

If we did include our 529 college savings and the value of our house, it would look like this:

Asset Tax Status

It’s also important to look at our allocation by tax status. (If the ACA subsidies disappear after 2025 as appears likely with the new administration, then we will start doing some Roth conversions in 2026.)

- Currently Taxable: 20.8%

- Not Yet Taxed: 34.6%

- Already Taxed: 44.6%

Recent Returns

I thought it might be helpful to include recent returns for our three major asset classes by investment (1 year, 5 year and 10 year). Again, this is more individual investment choices (funds) than we really need, but because of the different custodians due to asset location and legacy reasons, we have some funds that are very similar but not exactly the same. (You really only need one in each of these asset classes.)

Note: These funds don’t all fit neatly into these three asset classes. For example, VTSAX includes small and mid-cap funds whereas PERA’s U.S. Large Cap is only Large Cap. And SLYV is only small-cap value, whereas PERA’s Small/Mid Cap is all small and mid caps. But I think it’s still helpful to group them this way.

Our current yield for cash (and cash-like) is 3.8% for our Ally Money Market and 4.27% (current 7-day yield) for our Vanguard Money Market (partially state-tax exempt). We also have a decent amount in 6-month T-Bills with various maturity dates, typically in the ~4.3% range (fully state-tax exempt).

I’m not sure how helpful this is (if at all), but one of the big issues in personal finance is that many people are reluctant to talk about their finances. So my hope is that by sharing this it will help others be more comfortable talking about their portfolios (as well as other financial decisions they have made).

5 thoughts on “Our Current Portfolio and Recent Returns”