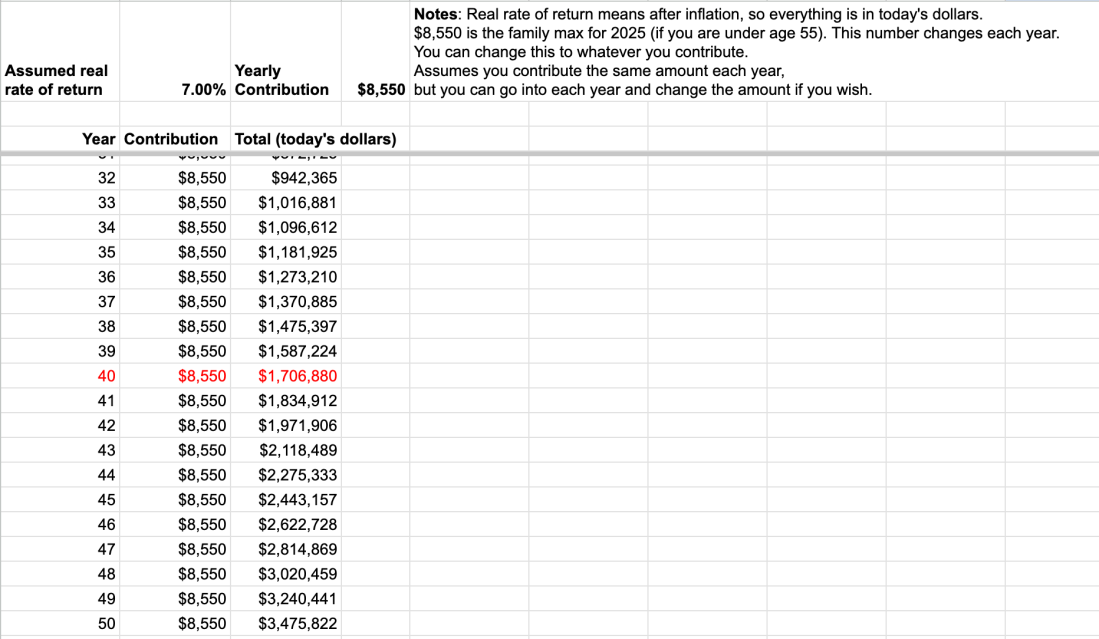

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Growth of HSA Over Time

Tag: saving

Spreadsheet: Medical and Dependent Care FSAs

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Medical and Dependent Care FSAs

Spreadsheet: Bank Accounts

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Bank Accounts

Spreadsheet: Cost of Car Ownership Calculator

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Cost of Car Ownership Calculator

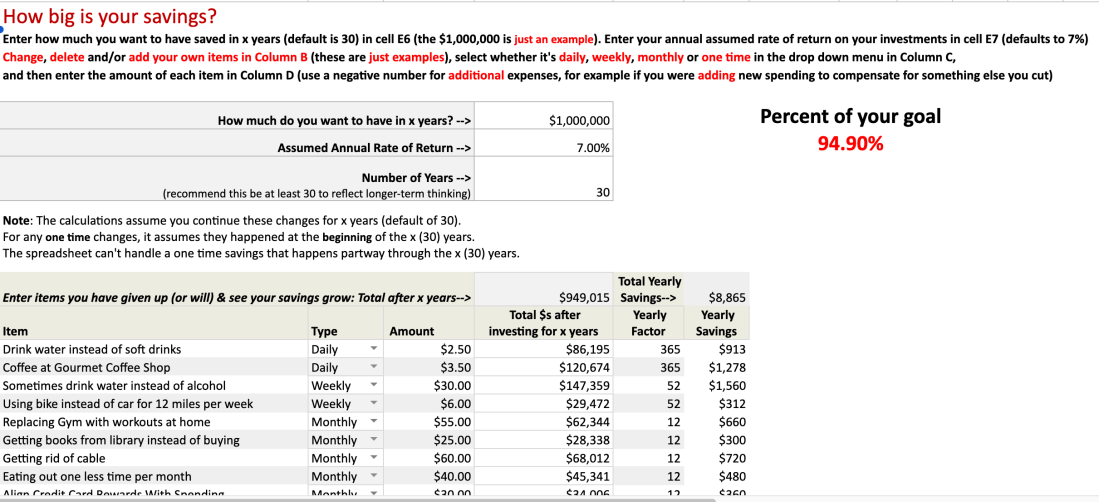

Spreadsheet: Growth of Savings Calculator

Some of the episodes in my new podcast series Teaching You to Fisch (Spotify, Apple Podcasts, YouTube) include spreadsheets I've created to illustrate particular topics. Some of them are modifications of spreadsheets I've used before and some are newly created. Because not everyone is going to choose to watch/listen to the podcasts (they are really … Continue reading Spreadsheet: Growth of Savings Calculator

Podcast Episode 5: Bank Accounts

I just released Episode 5 of the Teaching You To Fisch podcast. This episode discusses one of the basic “infrastructure” decisions you need to make, where to have your checking (spending) and savings accounts, and how many people are not making the optimal choices. Slides Transcript It's available on Spotify, Apple Podcasts, and YouTube, and … Continue reading Podcast Episode 5: Bank Accounts